The first Australian-built satellites to be launched in 15 years are set to take off this week from Cape Canaveral in Florida.

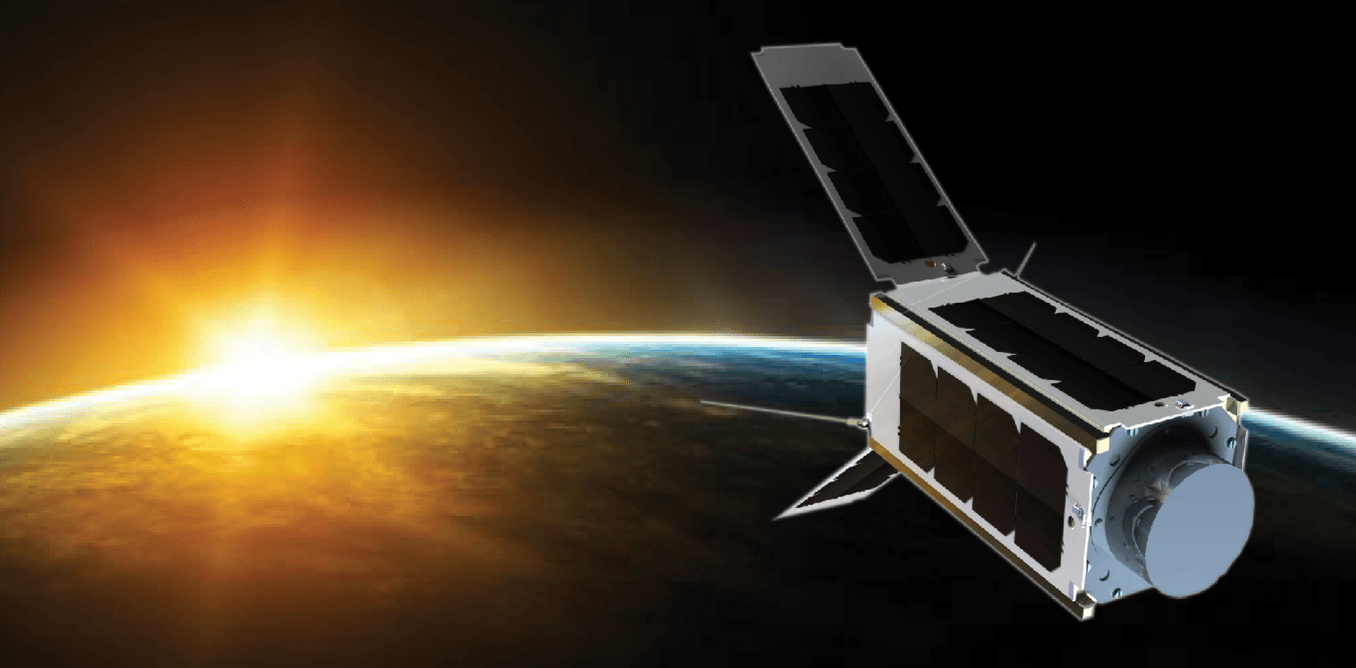

Unlike the enormous satellites Australia uses for telecommunications, each of these new satellites is the size of a loaf of bread. But although small, they may provide a key step in enabling Australia’s entry into the global satellite market.

Three types of cubesats are the Australian contribution to the international QB50 mission, in which 36 satellites from different institutions around the world will carry instruments provided by the Von Karman Institute (VKI) to examine the lower thermosphere. This is a very interesting part of the atmosphere for several reasons, such as the way it disturbs GPS measurements.

The cubesats will be first delivered to the International Space Station, and then released into their orbits.

One of Australia’s entries in the cubesat race to space.

The three teams that developed the Australian cubesats are: one from UNSW, one collaboration between the University of Sydney, the Australian National University and UNSW, and one collaboration between the universities of Adelaide and South Australia.

Once the VKI instrument and support systems (power, communications, and so on) are installed, there is still room for the teams to install payloads of their own.

The UNSW cubesat, known as UNSW-EC0, is running four experiments including a GPS receiver, and two boards testing radiation-robust software and self-healing electronics. The fourth experiment is to test the satellite’s chassis, built using a 3D-printed material never before flown in space.

The launch is significant, not just because it is so long since Australia built satellites, but because it could be the start of something much bigger.

Small is good

Globally, the space industry had an estimated US$335 billion (AU$440 billion) turnover in 2015. It’s expected to reach US$1 trillion (AU$1.3 trillion) by 2030.

This is an innovation sector Australia cannot ignore, and small satellites – especially nano-satellites or cubesats – offer Australia a way in.

According to a report last month by Allied Market Research, the small satellite market is expected to be worth US$7 billion (AU$9.2 billion) by 2020, with a compound annual growth rate of about 20%.

Analyst Spaceworks said in February that by 2023, the requirement for launches in the 1kg to 50kg class will be 320 to 460 satellites per year, more than 70% of them for commercial purposes.

Another analyst Euroconsult last year said there would be more than 3,500 small satellite launches in the next decade, worth US$22 billion (AU$29 billion) with launch earnings of US$5.3 billion (AU$7 billion). That’s a 76% increase over the previous decade.

Australia in space

This disruption has the potential to be more important for Australia than for any other developed nation.

Australia is the largest economy in the world not to have a space agency, which I have highlighted before, and suggested ways forward. As a result, Australia has not developed a traditional space industry.

Exploiting cubesats offers an opportunity for Australia to participate in this industry, despite the absence of an agency.

In the same way that the success of Rocket Lab forced New Zealand to establish a space agency, Australia’s success with cubesats could finally see the establishment of an agency here.

A gathering of space minds

The launch of the QB50 cubesats has been delayed several times and is currently slated for 1am (AEST) on Wednesday April 19.

So by sheer coincidence it will coincide with a gathering in Sydney of the Australian cubesat community – CUBESAT 2017: Launching Cubesats for and from Australia – that will showcase some of the remarkable progress Australia has made in recent years.

This includes three cubesat missions that have constructed satellites – QB50 mentioned above, and a further two from the Defence Science and Technology Group: Biarri (two launches of one cubesat and three cubesats) and Buccaneer (one cubesat).

A large number of Australian start-ups are looking to operate in the global small satellite market.

Several companies are developing launch capability, including Gilmour Space Technologies in Queensland. Other companies are developing ground segment capability to help manage operational satellites including Saber Astronautics in Sydney. Some are developing cubesat components such as Obelisk Systems in Maitland, New South Wales.

Ambitiously, there are also companies looking to develop cubesat constellations, which are large numbers of satellites with orbits optimised for global coverage for a range of different applications. The Australian leader at present is Fleet from Adelaide.

Government interest

CUBESAT 2017 is the second workshop of its kind. When the first was run, two years ago, there was no way then to anticipate the huge leaps Australia has made in this niche area of space.

Recently, the Space Industry Association of Australia released a white paper calling for a space agency.

There was some encouragement for the community in the response from the federal Science Minister, Senator Arthur Sinodinos, to that call when he said:

I’m quite excited at the idea of us doing more in space.

So there is hope we may see some developments.

In terms of cubesats, it is with great excitement we look forward to where we’ll be in the next two years, when perhaps we can say, with Australian-made assets in space, that the Australian space industry has finally been established.

Andrew Dempster is Director of the Australian Centre for Space Engineering Research at UNSW. He manages one of the teams that developed the cubesats mentioned and will host the workshop mentioned. He receives funding from the Australian Research Council.

Andrew Dempster is Director of the Australian Centre for Space Engineering Research at UNSW. He manages one of the teams that developed the cubesats mentioned and will host the workshop mentioned. He receives funding from the Australian Research Council.

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race