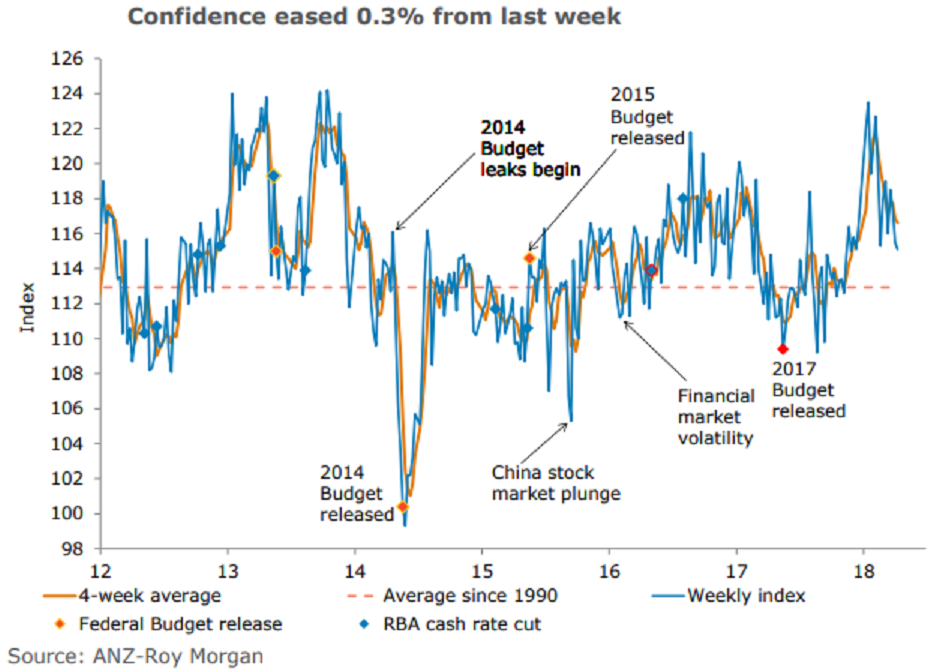

Australia’s ANZ Roy Morgan Consumer confidence eased for the third successive week as the latest reading fell 0.3 percent to 115.1. The underlying details were mixed, with two out of five sub-indices registering declines.

The drag came from views towards current and future financial conditions which continued the decline from last week, falling 1.5 percent and 3.4 percent respectively. Despite the drop, the four-week moving average of aggregate financial conditions remains comfortably above its long-run average.

Sentiment toward current economic conditions rose marginally by 0.9 percent after a similar 0.7 percent rise the previous week. Future economic conditions recovered some of the 1.1 percent loss posted last week to rise 0.7 percent in the latest reading.

The 'time to buy a household item' rose 1.5 percent this week, partially unwinding the previous week’s 3.6 percent slump. Inflation expectations edged down to 4.4 percent on a four-week moving average basis.

"We believe global news has dictated sentiment around economic sentiment, while more fundamental factors such as continued employment growth have helped maintain confidence in financial conditions," said David Plank, Head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran