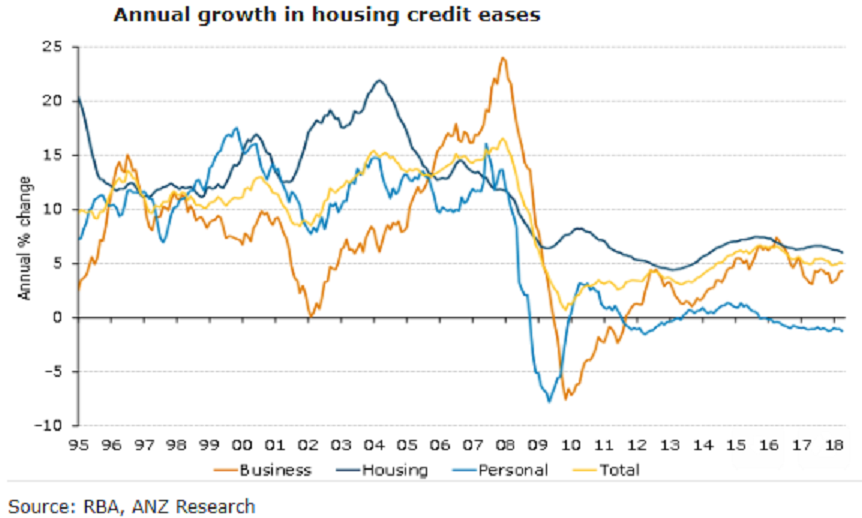

Australian private sector credit growth slowed a touch in April to 0.4 percent m/m. Monthly growth in all categories eased from the prior month, with the exception of owner-occupied housing which remained at 0.6 percent m/m. Annual growth in investor housing credit slowed to 2.3 percent and is set to slow further over coming months given the big drop in investor finance commitments in March.

Total private sector credit grew 0.4 percent m/m in April, slowing a touch on March’s growth of 0.5 percent m/m, which in turn was a pick-up from the 0.3/0.4 percent m/m growth seen since August last year. Annual growth remained at 5.1 percent y/y.

Housing sector credit rose 0.4 percent m/m, its slowest pace since December. This lowered the year-on-year growth rate to 6.0 percent (from 6.1 percent) which is the slowest since March 2014. Within the housing segment, owner-occupied credit growth remained at 0.6 percent m/m where it has been for most of the past eight months. Investor credit growth slowed to 0.1 percent m/m, with annual growth slowing to 2.3 percent y/y.

This is the slowest annual pace for investor housing since September 2016. The 9 percent m/m drop in the value of investor housing finance commitments in March suggests that investor credit growth will slow sharply in coming months, despite the removal of APRA’s 10 percent cap on loan growth and the easing of interest rates for many types of investor loans. The atmospherics around bank lending appears to be the driver of this.

Business sector credit slowed to 0.5 percent m/m after the downwardly revised gain of 0.7 percent m/m in March. Annual business credit growth still accelerated to 4.3 percent y/y, however. Personal credit fell 0.3 percent m/m, its biggest monthly decline since October 2015. It is down 1.2 percent over the year, its steepest decline mid-2012.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination