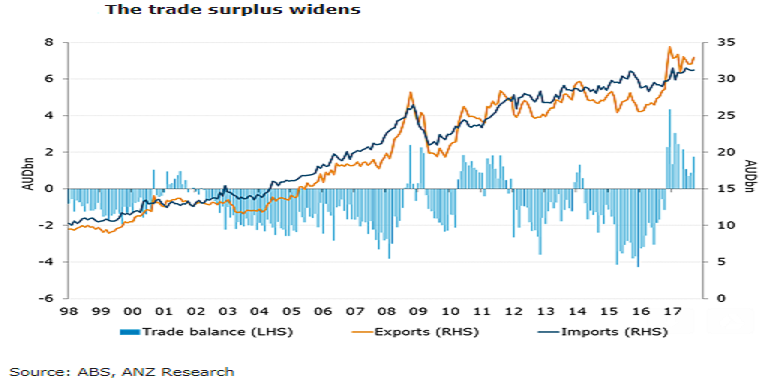

Australia’s net exports are expected to add 0.3ppts to third quarter real GDP growth, according to the latest report from ANZ Research. The country’s trade surplus widened in September to AUD1,745 million from a downwardly revised AUD873 million the previous month.

The improvement in the trade position was led by a rise in export values – up 2.9 percent in September. Metal ores and minerals (+8 percent m/m) and services (+1.4 percent m/m) were the main contributors to the acceleration in export growth.

Resources ex-nonmonetary gold saw the fastest increase in the month (+3.8 percent m/m). The strength in metal ores and mineral (+8 percent m/m) offset declines in coal (-0.3 percent m/m) and other mineral fuels (-1.2 percent m/m). Encouragingly, service exports (up AUD102 million) continued to strengthen, growing 1.4 percent m/m.

Import values were steady for the second straight month in September. Imports of intermediate goods and services both fell in the month, down 0.4 percent (AUD35 million) and 1.3 percent m/m (AUD97 million), respectively. Imports of consumption goods grew, after declining in the prior two months, increasing AUD191 million (+2.4 percent m/m).

However, capital goods imports improved (+0.9 percent m/m), likely reflecting the strong pipeline of infrastructure projects. Service imports were a drag as they fell AUD97 million (-1.3 percent m/m).

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data