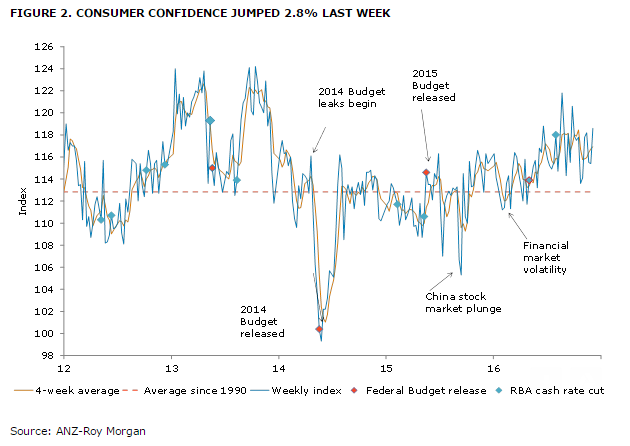

Consumer confidence in Australia jumped to its highest level in 10 weeks, during the week ended December 3, following improved household optimism over their future finances.

Australia’s ANZ-Roy Morgan consumer confidence rose a solid 2.8 percent in the week ending 3 December. The headline index is now at its highest level in ten weeks. The details were also positive.

The strength in the headline index was broadly based, with the biggest improvement coming from a 4.4 percent jump in households’ view of future finances. Households’ views of their finances compared to a year ago also improved, but by a much more modest 0.2 percent.

Households’ views of economic conditions over the next 12 months rose a strong 2.9 percent, while household’s view of the economic outlook in the next 5 years bounced a solid 2.2 percent. After three weeks of straight declines, household views on whether ‘now is a good time to buy a household item’ rebounded by 4.0 percent last week.

In addition, the 4-week moving average of inflation expectations continued to edge higher and is now up to 4.1 percent from 4.0 percent last week.

"This week’s GDP report and RBA meeting will likely shape the news flow in the coming days and have the potential to influence consumers’ confidence over the coming week," said Felicity Emmett, Head, Australian Economics, ANZ.

Meanwhile, the AUD/USD is trading bearish at 0.74, down 0.15 percent, while at 5:00GMT, the FxWirePro's Hourly AUD Strength Index remained neutral at -20.89 (a reading above +75 indicates bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record