Australia’s fourth-quarter business indicators data came in weaker than market expectations, with profits, wages and inventories all coming in below consensus estimates. These numbers provide some downside bias to the estimate in the Q4 gross domestic product (GDP), due for release on Wednesday, ANZ Research reported.

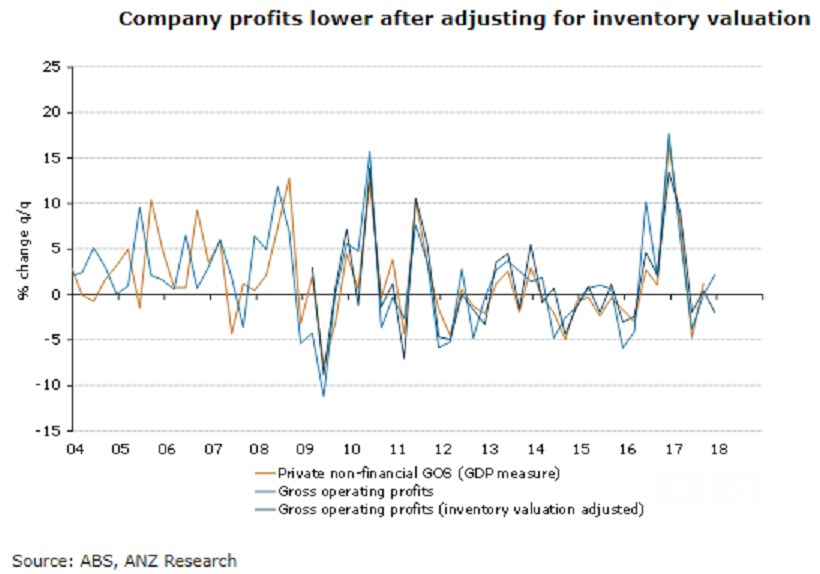

Company profits posted a solid headline rise (+2.2 percent q/q) in Q4 following a modest decline of 0.1 percent q/q. After adjusting for inventory valuations the result was much weaker, however, with profits actually falling 2.4 percent q/q.

Non-mining profits rose 1.2 percent q/q to be 5.8 percent higher than a year ago. While this is a solid result, the buoyancy in business conditions and profitability indicators would have suggested a stronger result. By industry, the numbers are volatile quarter to quarter, but in terms of annual growth, the areas of strength are administrative services, utilities, wholesale trade, and finance.

"Conversely, one of the weakest sectors is construction, which seems surprising given the strength in activity. We expect that non-mining profits will continue to strengthen given ongoing elevated business conditions. Mining profits rose 4.2 percent q/q, with commodity prices relatively flat in Q4" the report added.

Growth in the wages bill was solid, although not as strong as was expected. It rose 1.0 percent q/q, following a 1.3 percent rise in Q3 (upwardly revised from +1.1 percent), bringing annual growth up to 4.3 percent. The wages bill is being supported by strong growth in employment and further gains should support growth in household incomes and consumption.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility