Australia’s gross domestic product (GDP) for the fourth quarter of 2017 disappointed market expectations, following weakness in business investment and net exports, while household consumption grew solidly. The result highlights the still patchy nature of growth and the subdued nature of inflationary pressures in the economy.

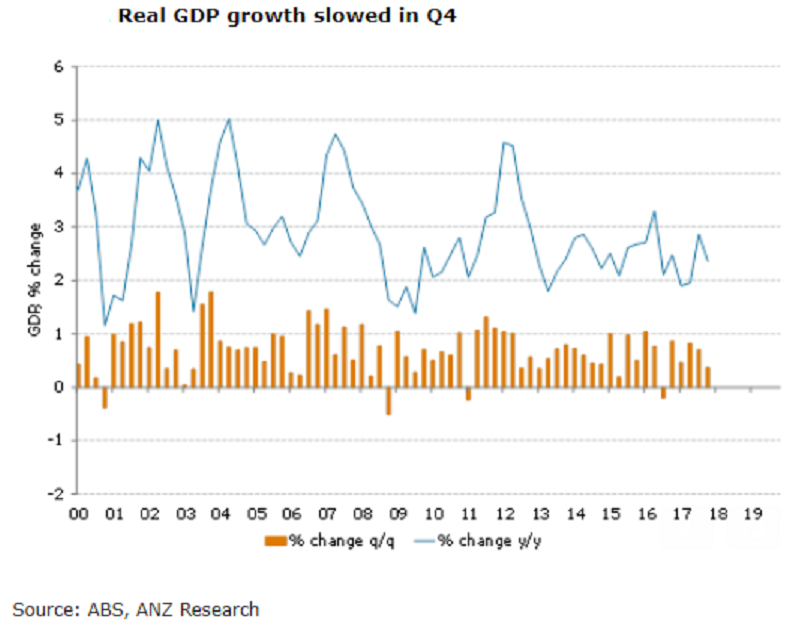

GDP was up a modest 0.4 percent q/q in Q4, bringing annual growth down to 2.4 percent. For 2017 as a whole, GDP rose 2.3 percent, which is the slowest annual average rate of growth since 2013. The result was in line with ANZ research’s forecasts but a touch below market estimates and the RBA’s forecast published in the February Statement on Monetary Policy.

Growth was held down in the quarter by weakness in business investment. After four straight rises, it fell 1.0 percent q/q. The weakness was driven by a solid fall in mining investment (-5 percent), which wasn’t sufficiently offset by strength elsewhere.

The non-mining investment was essentially flat, although annual growth remains solid at +11 percent. Dwelling investment was also weak, posting a fall of 1.3 percent q/q. Elsewhere, household consumption growth was strong, rising 1.0 percent q/q, following an upwardly revised 0.5 percent rise in Q3 (previously +0.1 percent q/q), while public spending grew a strong 1.1 percent. Inventories were flat, while net exports subtracted 0.5ppt from growth, in line with the Balance of Payments report.

For policymakers, the number is likely to be a little disappointing, given H2 2017 growth has stepped down to 2.1 percent from 2.7 percent in H1. While the pick-up in consumption is reassuring, it needs to be considered in the light of the ongoing downtrend in the saving rate.

"We are reluctant at this stage to extrapolate the weakness into 2018 and continue to expect a strengthening of growth this year. The weakness in wage growth confirms that the RBA is likely to be on hold for some time yet," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom