Australia’s capital expenditure is expected to have risen slightly by 1.3 percent q/q during the third quarter of this year but not by enough to unwind the previous quarter’s fall, according to the latest report from ANZ Research.

On the other hand, a soft buildings and structures spend is likely to weigh on the headline result. We think non-residential building will again be weighed down by further falls in mining-related engineering construction.

Further, a solid upward revision for 2018-19 spending plans is expected, from AUD102 billion to AUD110 billion. Part of this reflects the fact that businesses almost always upgrade their intentions at this time, as the current financial year is underway.

In particular, non-mining capex for 2018-19 is expected to be revised upward to AUD77bn from AUD70 billion. This would imply a mild increase of 2.1 percent y/y, which would still be an improvement from the flat result implied in the Q2 release, the report added.

A raw non-mining estimate above AUD80 billion would be a strong result. This would imply growth of 6 percent y/y, which would build nicely on the 10 percent y/y growth realised in 2017-18.

Conversely, an estimate below AUD75 billion (-0.7 percent y/y) would be a disappointing result, as it would mean that the outlook has worsened despite solid business conditions.

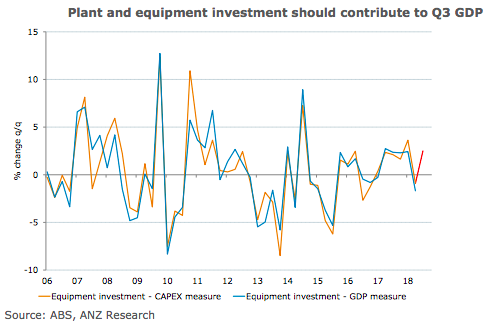

"We expect spending on plant and equipment, which will flow directly into Q3 GDP, will post growth of 2.5 percent q/q. This positive outlook is underpinned by elevated business conditions and investment plans," the report commented.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record