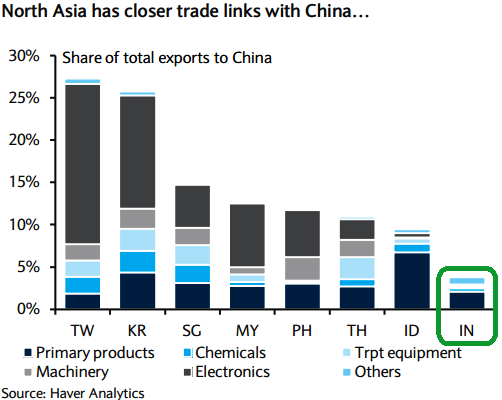

Industrialized Asian nations, especially those countries in close proximity to China, have been hit harder. North Asian exports to China have fallen more sharply in July and August, setting the stage for a shallower recovery in growth momentum in Q3 than earlier expected. The depressive effect of lower oil prices intensified after oil prices dropped 33% since May.

North Asian economies will see slower growth, while ASEAN battles market volatility and weather risks. India, and to an extent Indonesia, remain bright spots. Weaker currencies will complement existing policy support amid low inflation. Trade compression hurting growth Intra-Asia trade compression is hurting regional growth, as China decelerates faster than expected.

The recession in goods starts to bite the sluggishness in Q2 has extended into Q3, with the effects of decelerating Chinese activity spilling over into the region. This is reflected in the downgrade to our China assumptions, which now factors in a slower growth path in H2, lowering 2015 growth to 6.6% (previously: 6.8%).

Meanwhile, the uneven recovery in developed markets, coupled with weaker EM demand, has resulted in excess inventories in the two main supply chains - in autos and electronics. This is constraining production, shipments and purchasing activity between Asia's centres of production, resulting in lower intra-Asia trade. However, we believe Christmas orders from the US will be strong enough for activity to bottom out.

These have led us to cut our 2015 growth forecasts for six countries since the June edition of the Emerging Markets Quarterly, most notably Korea (0.7pp), Singapore (1.4pp) and Taiwan (2.3pp) in industrialized Asia and the Philippines (1.0pp), Thailand (1.0pp) and Indonesia (0.2pp) in the rest of EM Asia. Only Malaysia was revised higher, by 0.5pp to 5.0%.

The silver lining is India, as the growth outlook there continues to improve despite the weaker-than-expected Q2 GDP outturn. This is led by increased infrastructure spending on stronger indirect tax collections at a time when additional monetary easing is being delivered.

Asian trade contraction on Chinese slowdown - India remains bright spot in Asia

Friday, September 25, 2015 12:45 PM UTC

Editor's Picks

- Market Data

Most Popular

3

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings