Abenomics, named after Japan's Prime Minister Shinzo Abe, who after coming to power influenced policies that resulted in one hand Bank of Japan (BOJ) providing massive stimulus through balance sheet expansion in tune of ¥ 80 trillion per annum and sales tax hike from 5% to 8%.

These policies together known as Abenomics was aimed to revive Japan from more than decade long deflation and to balance Japan's massive fiscal imbalance with debt to GDP ratio at 230%.

These policies resulted in massive devaluation in Yen, which rose from just around 76 per Dollar, back in 2012 to 125 per Dollar in 2015.

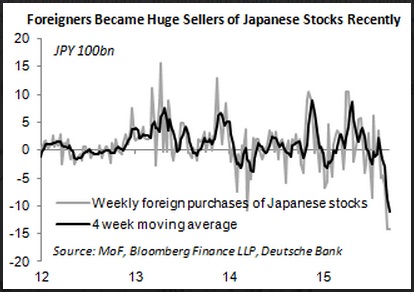

Nikkei gained from around 9000 to close to 21,000 by 2015. Even till summer of 2015, Japanese stock has been experiencing massive foreign inflow, which started to reverse in recent times have reached fastest pace since crisis.

End of buying by Japan's pension fund, largest in the world with $1.7 trillion assets and downgrade by S&P is weighing extra on Japanese stock market, which is down close to 11% in last three months.

Japanese economic dockets continue to pose doubts on Abenomics' ability to revive Japanese economy and reverse deflation, which makes two trades at risk of reversal - Long Nikkei, Short Yen.

Nikkei is currently at 18000, while yen is trading at 120.4 per Dollar.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand