Not everyone is crying foul over turmoil in China, while stock market assets had their worst start in 2016, some of the safe haven bulls having their best of times.

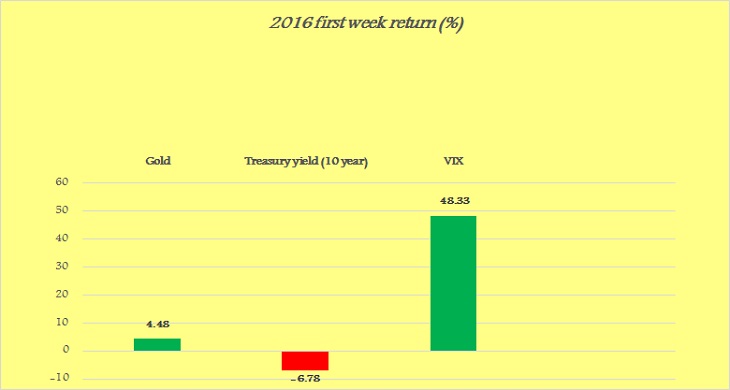

As it has been worst start ever for S&P 500, VIX had its best. As of Friday's close, in one week to New Year, rose 48.3%. Since 2208 crisis, due to Federal Reserve's asset purchase program, VIX, known as the fear gauge of the market has become an asset in itself. Shorting the VIX, during asset purchase era has been one of the top trades since crisis, however with FED hiking rates many doubt, if shorting volatility would be a good trade.

Gold, which has largely been mute, over risk aversion for last few quarters, has recently started responding to risk aversion. Gold had its second best start to a year in 2016, with 4.3% rise last week.

Similarly, bond market had partied full last week. Despite threat of higher rates ahead, treasury 10 year yield dropped -6.78%. Treasury yield is inversely proportional t price. At one hand, investors preferred safety of the bonds amid market turmoil, on the other investors seem to be reducing bets of faster hike from US amid market turmoil.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022