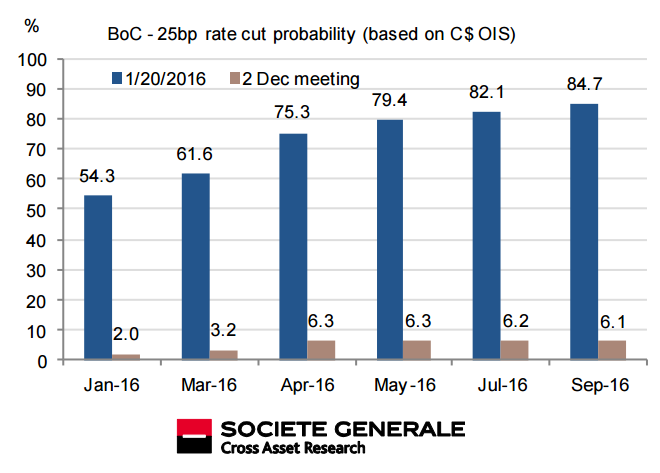

The recent commodity price meltdown and especially the crude's struggle causing the reaction function of firms in the Canadian oil and gas sector proposes that business investment may be even more of a drag on 2016 growth than previously thought. The Business Outlook Survey by Bank of Canada has been lackluster in Q4 2015 and has amplified this theme, as investment intentions moved to their lowest readings since the 2009 recession. This has prompted the market to price in the increased probability of a rate cut at the January 20 meeting. Regardless of whether or not the Bank of Canada cuts rates, we believe that the uptrend in USD/CAD will persist. The 1.5000 level now serves as an anchor for the market from a behavioural/sentiment perspective.

Of all the G-10 currencies, the Canadian dollar was hit the hardest in 2015, dented by firmer US interest rates, weaker oil prices and sluggish domestic data. The loonie lost over 15% of its value versus the U.S. dollar, Japanese Yen and British pound. The CAD sell-off was so severe that it drove USD/CAD to a 12 year high, levels not seen since 2004. 2015 was an extremely difficult year for Canada, and the negative factors noted above still remain intact supporting arguments for more CAD weakness in the weeks ahead. Interest rate differentials for US/Canada 2-year government bonds have widened to around 60bps, the biggest yield advantage for the USD since 2007. While spreads remain wide, or widen further, the USD is unlikely to backtrack.

BoC Governor Poloz believes that stronger U.S. growth, a weaker Canadian dollar and rate cuts delivered in the first half of the year will help the economy recover and avoid the need for unconventional policies such as quantitative easing. The risk is clearly geared towards more CAD weakness, USD/CAD is likely to strengthen significantly in the early stages of the calendar year. 1.42/1.45 levels for USD/CAD should not be a surprise before the end of Q1 before some consolidation sets in through Q2/Q3.

"We continue to favour USD/CAD long positions from a short-to-medium term perspective but we also think the CAD is starting to look relatively attractive against some of its major currency peers where relative monetary policy (EUR) or value (AUD) considerations suggest the CAD looks a little more attractive now", says Scotiabank in a research note.

The Bank of Canada is likely to remain on hold at today's policy meeting. The market are however pricing in a 54% probability of a rate cut today and 25% probability of easing in March because of BoC Governor Poloz's surprising optimism but those chances will grow as the year progresses. The market will approach the decision cautiously and the CAD may find itself slipping if the central bank sounds dovish in its outlook for the economy. At the time of writing USD/CAD is trading at 1.4650, levels unseen since March 2003.

2016 likely to be another devastating year for the Loonie

Wednesday, January 20, 2016 12:01 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal