The crude oil markets were steady from the last couple of weeks, WTI futures for November delivery on the NYME rose 1.03% to $50.81 a barrel, while with front-month Brent futures almost unchanged from last Friday at the time of writing.

Having begun the week on a positive note, following a deluge of producer headlines concerning Russia’s potential participation in the upcoming OPEC negotiations, prices have slipped back in recent days.

Mid-week data from the US government revealed the first week-on-week build in US crude stocks since late August, although the data now exclude the lease crude stocks as they are now deemed not commercially available.

The collapse in US refinery runs underpins most of the shift in the crude inventories, falling 480 kbd on the week, to the lowest level since early February, as seasonal refinery maintenance approached it peak.

Elsewhere, preliminary Chinese import data showed another strong crude monthly import total of 7.9 mbd on a net basis. This was the second strongest on record, after February 2016’s level.

The U.S. Energy Information Administration would release its weekly report on oil supplies at 14:30 GMT, expectations for a drop of over 2.5 million barrels.

Hedging frameworks:

The bulls have shown clear buying interest so far from last couple months to substantiate the signals offered by leading indicators on monthly, but for now, crude oil is crawling reluctantly between minor gains and losses during European trading session on today ahead of U.S. supply estimates in focus.

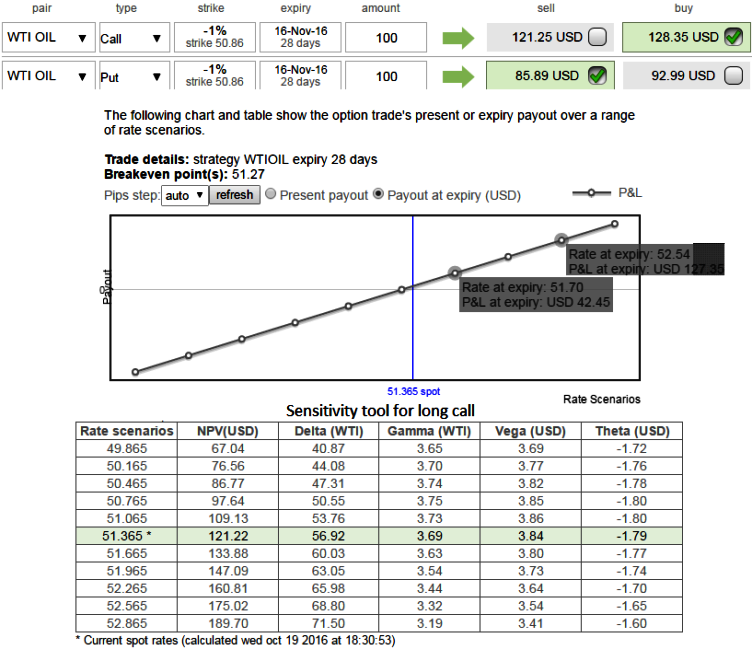

Thus, on hedging grounds we would like to deploy 1M in the money WTI +0.51 delta call option (1% strike) and simultaneously, short an out of the money call (1% strike) of 2W tenor with positive theta or closer to zero.

This would mean that the chances of upside risks of would be taken care by long positions (ITM calls), while option premiums on writing a put would reduce the cost of hedging.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed