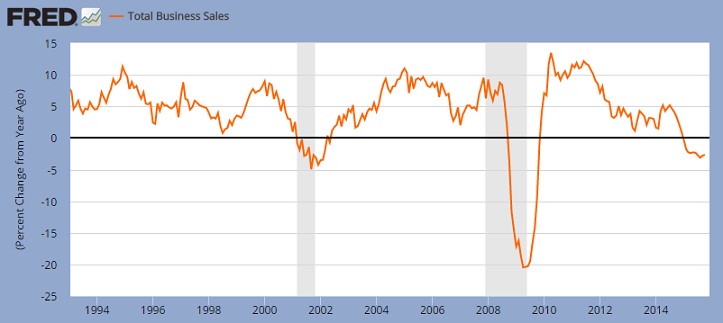

In our previous discussion of Total Business Sales (TBS) of US, released US Census Bureau, we pointed its divergence with S&P 500's rise. TBS growth has fallen and staying below zero since January this year and S&P's alignment to this fundamental is only a matter of time in absence of extra ordinary monetary policy.

Share price, however can be driven by more than fundamentals some time, especially in the presence of extraordinary monetary stimulus across globe.

Economic fundamentals are on other hand has been more aligned to Total Business Sales (TBS). In prior article, we discussed negative growth rate in US might be pointing to an impending US recession going ahead.

TBS might also be pointing in the same direction. For last two decades, at least, negative growth (which is happening now) has been accompanied by recession, both in 2001, post dot-com bubble burst and in 2008. During 2001 recession, drop in TBS growth touched close to -5%, while in 2008 it was much more severe, surpassing -20% growth. In 2015, TBS growth has broadly been negative, touching lowest point in August (-3.1%).

Though there is no guarantee, especially with monetary accommodation that Recession is imminent but this figure is likely to keep us cautious.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022