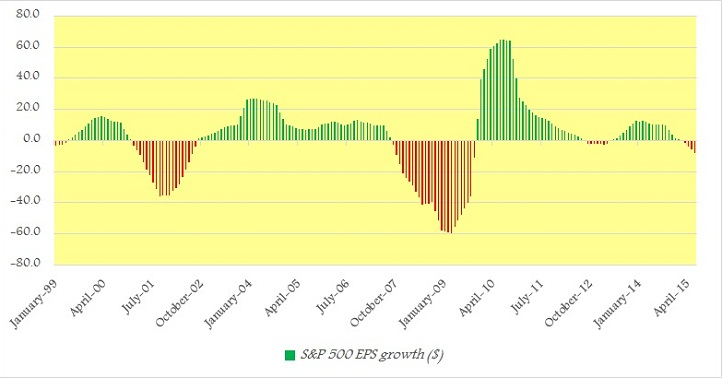

In this series, we have been warning of some worrying signs in US financial market and economy some of which are showing increased risk of recession, others are pointing at an inevitable large correction in S&P 500 (if not crash). Divergence between Total Business Sales (TBS) growth has been of particular concern and if that chart has made you worried, our earnings per share (EPS) of S&P 500 might give you goosebumps.

Simple data mining, reveals in 2015, US companies are finding it extremely difficult to best both top and bottom line. So far we have S&P 500 EPS data till June, which shows EPS growth has fallen to negative on yearly basis. Last time EPS growth was negative during 2012 Euro Zoe debt crisis era and before than back in 2008/09 crisis. Moreover EPS growth hasn't been this negative since financial crisis.

In June, 2015 monthly EPS has fallen by -$8.3 from a year ago, a level of drop not seen since October, 2009.

Moreover, third quarter estimate suggests it could be uglier.

S&P is however still holding its head high above 2000 mark, trading at 2059. This divergence is worrisome.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed