The US Federal reserve is right to worry on looming inflation, as higher inflation without compensatory growth would eat away the purchasing powers of the consumers. In addition to that, a higher inflation uptick means that the FED would have to unwind its asset portfolio fairly quickly.

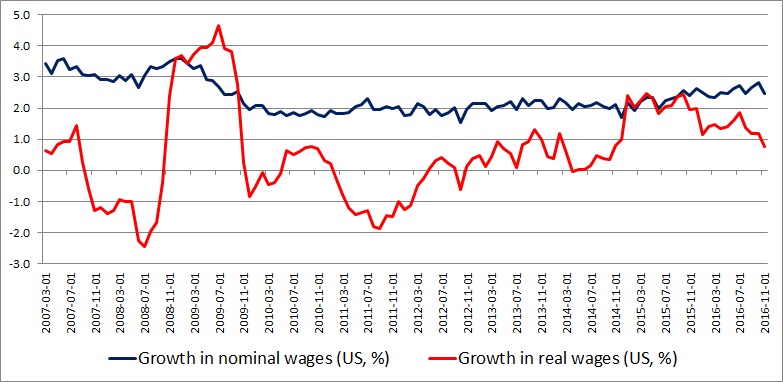

Since the great recession of 2008/09 the growth in the nominal wages in the economy remained fairly stagnant, despite a steady decline in the unemployment rate from 10 percent to 4.8 percent. Only since 2015, it has shown some upward pace. Several times, throughout the past year, several times the FOMC has mentioned in their statement that the household earnings remained solid and indicated in 2015 that the drop in the oil price would benefit the consumers by increasing their spending powers or real wages.

However, the same Federal Reserve failed to mention, what we can see from that graph that since November 2015 there has been a steady decline in real wages as inflation rose at a faster pace compared to the real wages. While the nominal wage growth (2.5 percent) has hit the highest level since the crisis, real wage growth (0.8 percent) has touched the lowest level in more than 2 years.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off