Markets are nervous heading into the FOMC decision due tomorrow. With the hike in the fed funds rate well flagged, focus is likely to shift from the initial hike to the subsequent path as to be detailed in the statement to follow. Investor focus shall remain mainly on the following:- Firstly - the tone of the FOMC statement and especially the press conference; Secondly - any changes in the dots; and Thirdly - the Fed's updated economic forecasts.

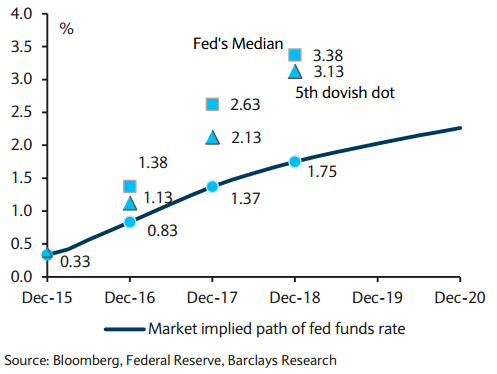

Economy forecasts are largely to be as expected, not many surprises are foreseen, though the Fed might take down its end-of-2016 forecast for core inflation by a tenth. Expectations for the median dots for both the year 2017 and for the terminal funds rate are to come down by 25bp; the markets continue to imply an even more gradual path.

The market stands divided on the size of the liftoff and the expectations could be influenced by the monthly US CPI data due later today. US CPI inflation for November will be the last major data release before the FOMC meeting, expectations are for a flat reading. U.S. dollar remained vulnerable. Dollar long positions were being liquidated at a faster pace than expected and USD could face additional pressure if U.S. Treasuries are bought back on relief that the Fed's rate hike cycle will be quite a slow one.

"The first Fed hike in nine years is likely to be accompanied by dovish rhetoric in the press conference, especially against a backdrop of lingering disinflationary pressures globally, a new low in oil, and fairly rapid USD/CNY depreciation", says Barclays in a research note.

Fed Chair Yellen is likely to emphasize that the FOMC remains data dependent and the path of rate hikes is not pre-determined. There are definitely no expectations for a numeric guidance about the meaning of 'gradual', but she may point to the dots as indicative, noting both upside and downside risks to the path. Yellan is also expected to reiterate that these effects are transitory and will fade over time.

EUR/USD hit session highs at 1.1060 on broad USD weakness, but then edged lower as USD found traction following halt in oil and equities slide. At 1050 GMT the pair was trading at 1.1013, while USD/JPY was at 120.98.

With the Fed rate hike well flagged, "Tone of Conference" will be the key to drive markets

Tuesday, December 15, 2015 11:22 AM UTC

Editor's Picks

- Market Data

Most Popular

3

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence