European Central Bank (ECB) president Mario Draghi, in his last policy meeting left the door open to all kinds of adjustment to its super easy monetary policy, ranging from deposit rate cut to tweak in asset purchase program by various parameters or combination of many.

However, market seems to be fixated over at least deposit rate cuts. From the current market pricing a deposit rate cut by European Central Bank as near surety.

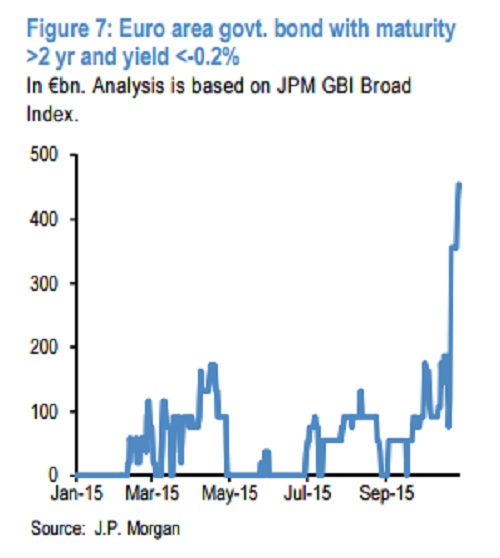

Analysis by US investment bank J.P. Morgan showed -

- As of now almost € 454 billion worth of longer duration (2 year-30 year) European bonds are trading below deposit rate of -0.2%, making them not eligible for European Central Bank's (ECB) asset purchase program. The surge in the amount (shown in the chart) has been most prominent since ECB indicated further easing.

- As the calculation goes, almost 11% of the European longer duration (2y-30y) bonds are below deposit rate. For Germany it is almost 30%. Totally 16% or € 1 trillion worth of European bonds are trading in negative.

With such one sided pricing and liquidity it is most likely than not, that European Central Bank (ECB) will reduce deposit rates by 10 basis points further into the negative.

Euro is trading at 1.11 against Dollar.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate