As an add on for my miners and refiners, I do watch the price movement of ferrous metals, and yes, as of late they have just tanked downward with iron leading the pack at -16%, steel (-6%), aluminum (-7%), copper (-9%) and nickel (-8%), with all of these markets just cratering to new lows and with record breaking downward action in some cases, resembling more of an anvil dropping off a cliff, rather than the normal day to day trading action. In some areas, such as rolled sheet steel, it was limit down last week, which ended up being 6% of the entire base price of rolled steel. All the while China keeps telling us how strong it is, but their usage numbers as of late, are proving to be very significant to me, as my first number-crunching review of the last batch of numbers released from China showed a 7% lowering in base metals usage (YTD). Something is going on in the Silk Road area, and they aren't sharing it with us. Chinese rebar steel futures posted their biggest intraday fall in seven years as the worries about demand in the world's second-biggest economy extended a rout that has spilled over into most of the other industrial raw materials. Tin got clobbered 2.5% in Shanghai last week, along with copper being 2.5% lower, as it tested the February 25th old lows which continues to be beaten down on the global front.

So as I slowly started to polish the crystal ball on the prophecy shelf this week, I began to see the stars coming into alignment. The flow of both raw ore and scrap metal has been very high on the world front. The Refiners and Miners that hedge with me, have had a steady and regular need for risk mitigation on the Tornado Hedging Platform which we own and run here at Zaner Precious Metals, and this is my major indicator of stable production yields across the board. The flip side of this universe is my wholesalers of minted metals have been very steady in their sales and deliveries of metals. So as the yin-yang of the trading world flows there has been somewhat of the usual flow as demand for Platinum, as the catalyst in a catalytic converter, and gold sales to Dentists and Jewelry makers, is very steady. Silver is going out to our industrial clients that use it in everything from phones and keyboards to window pane production, to increase the R factor in the glass. So as you can see the crystal ball is a little murky at this point.

So the real wild card in the deck is the anticipation of the movement that should be coming from a near zero interest rate market, and oddly enough it is just not that large. The zero rate has “felt” more supporting than driving of prices, more of an underlying base than a push, if you will. Right now, I at first thought that little engine that could, seemly was being fueled by hedge funds, banks, and speculators. The 20% jump in the price of gold to date had to come from this group, as it’s just too strong to be construed as a consumption rally for usage, because I see those numbers daily. So I had to drill down a bit on this group. As I have learned, the Banks and Hedge Funds are really superb trend followers, and the trend has been down for more than a few years, and actually this trend really started its downward move back about four years ago, so as the market continued down, and the interest rates worked slowly lower, their trading positions got ever bigger thereby exerting more downward pressure on all the metals. Couple this with the global stock markets, return on investment, which has been good, but these particular type of short futures positions have been producing huge profit margins by comparision, plus all good traders press the winners.

So just like the Jets and the Sharks in West Side Story, you got the Miners, Refiners & Bullion Dealers on one side of the schoolyard and on the other end of the yard are the Sharks, the Hedge funds, and the Banks all lined up and ready to rumble. Now as they prepare to stick each other with sharp little pointy objects and bludgeon one another over the head with blunt objects, Officer Krupke, da Speculator, steps into the yard. And he says, “Hey you mugs I got jammed up in the last collapse”, so I want some gold and silver coins as insurance from another fall and then he proceeds to buy 21% more gold this first quarter over last year (World Gold Council 1/12/16). And the cascade starts to change momentum as it slow starts to move the needle up as the miner sells to the refiner and the refiner sells to the wholesaler and the retailer ends the chain by selling to all of the officer Krupkes and his family and their friends. And then the rally starts in earnest, because the market was so grossly oversold, any little push initiates a bigger and bigger move as there is no one left to sell the market down again, and a $230 dollar upswing takes hold and feeds on the lack of selling.

So now the age old question remains, how many years of dangerous of borrowing habits, formed from robbing Peter to pay Paul will once again be tested and just how far? What happens if & when Peter himself runs out of money and Maria is left standing at the aisle waiting for Tony? Will Maria and all her friends start to buy coins as well? Are we looking at the potential for Shark frenzy in the coming year?

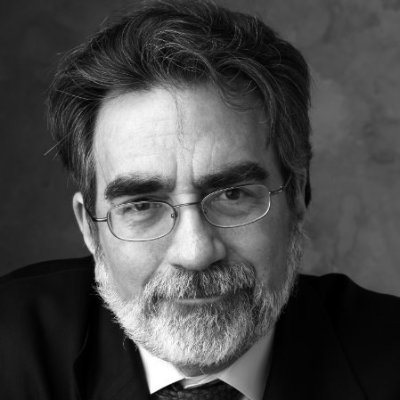

Peter Thomas is a Senior Vice President at the Zaner Precious Metal Division and he is considered one of the leading gold authorizes in the world today. As a licensed floor broker, he was a filling broker in the silver pit when silver ran to $55 an ounce. He currently manages a global cash desk which handles Refiners, Recyclers, Mining Operations and Coin & Bullion companies. He is constantly in demand for his insightful opinions drawn from his 35 years of metals trade to such news companies and magazines publishers as EconoTimes, Bloomberg News, WSJ, The Guardian,US News and World Review, Hard Assets, Kitco, and Modern Trader magazine. Contact him at @Goldbug111, (312) 277-0140 or [email protected].

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand