It’s hard to believe that a 3,000 year old market can be so vital and dynamic in our current modern society. The recent batch of economist’s mantra want you to believe that gold is a static market as gold “pays no interest”, so it has no returns just like the T-Bill market. That’s all good in the Econ class room with your PC edited school book for the Econ #101 studies, that is, until when you enter the modern trading offices like Zaner Precious Metals where gold is held as an underlying currency that is hedged around the globe 24/7 and then options are structured and written against the metals underlying value as it spreads them out in Calendar Trades spanning many years into the future to produce a yield curve on multiple exchanges. In today’s markets, gold is as dynamic as any other asset and it certainly is as sophisticated in the trading world as any synthetic swaps trades in the bond world. The underlying difference is at the end of the day you own gold and not paper.

Peering down the looking glass at today’s global situations, we are forming a broad base in the gold market after its rather perspicacious fall which shouldn’t be ignored. So let’s take a look at what’s forming this basing action in the shiny metal.

After what was close to a decade of battling in Afghanistan, you would have thought the Soviets/Russians would have learned their hard felt lesson. The idea that Putin is back fighting on sand again could really be the final straw on the camel’s back which could lead to the final break in the Russian economy. Let’s add to this “lesson” that the Russians just ‘Buzzed” the Turkish border to announce themselves being there again, and for the effort they were promptly fired upon and had one of their jets blown out of the sky by a Turkish surface-to-air missile. Also to further add fuel to the global war drums, multiple warring clans in Afghanistan announced that they would set aside their differences to band together to form a Jihad or sacred holy war against Russia again. Putin is by no means a foolish man but whatever the end game is here, it is helping to build a base under the gold market and drive my bullish meter into the green side again as another war becomes larger and much more convoluted.

The consumption side of metals in the East is nothing short of staggering. I’ve been trading metals since Moses bought his first pair of sandals, and no one has even seen the consumption of gold to the likes that we have in just the last few years. China believes that the current market in gold which is 2.4 trillion dollars wide will exceed 5 trillion dollars in trade in less than 10 years. Leading off with China, India and then Russia, the amounts being purchased are now regularly reported in tons every month and they are all ending up in National Banks. Russia just walked into the metals market and bought one million ounces of gold last month and they’re not the biggest player in the precious metals by any stretch of the imagination. It is my belief that countries that haven’t been able to form any true recognition of their currency on modern trading exchanges, so as to trade and hedge their currency, are buying all the gold they can get into their vaults to formulate swaps in the business community to meet current and pending debt. These swaps are also forming a base or underlying zone to hold prices steady at current levels, and as of late, or drive up the metals.

The final reason I’m now friendly to the metals market is the total failure of major companies to properly hedge integral risk inherently associated with market movement in the commodities arena. Glencor, an acronym for Global Energy Commodity Resources, is currently on the brink of collapse with its debt estimated at 30 billion dollars, Glencore claimed today that it is still financially robust, presents the market with a two edge sword. Glencore is going to have to liquidate metals in their warehouses to meet creditors debit demands. This should apply some downward pressure as product comes to the market, but in the long run it’s one less major producer, which would be able to continue to feed the current metal shortages condition for some time to come. Glencore also closed one of the two major Platinum mines last week and South African miners announced that 50% of all producing mines were unprofitable.

Gold is one of the only commodities whose value is even with or higher on the year, and the underpinning’s just keep getting stronger as Western societies continue to believe that printed paper is worth more than hard assets that come from the earth. The rest of the world seems to disagree with this position and the consumption of gold continues to flow into the vaults of offshore depositories at record paces as the western giant sleeps. This current trend of natural resources disappearing into the state vaults of the major powers is telling us that more is going on in the global arena than meets the eye and as long as this fundamental shift in refined metals is on it shouldn’t be ignored.

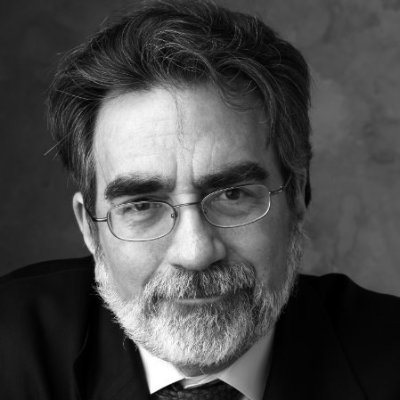

Pete Thomas is a senior vice president at the Zaner Precious Metal Division. As a licensed floor broker he was a filling broker in the silver pit back in the days when silver ran to $55 an ounce. He currently manages a global cash desk which handles Refiners, Recyclers, Mining Operations and Coin & Bullion companies. He is constantly in demand for his insightful opinions drawn from his 35 years of metals trade to such news companies and magazines publishers as EconoTimes, Bloomberg News, The Guardian, Hard Assets, Kitco and Futures magazine.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed