BOJ has held steady its bazooka-like QQE for about two and a half years, but the lack of inflation and weak economic growth kept alive expectations for further stimulus dosage again as early as next month. October is shaping up as a key month for the BOJ, with almost one-third of economists surveyed by Bloomberg forecasting the central bank will add to its stimulus when it updates its estimates for growth and inflation.

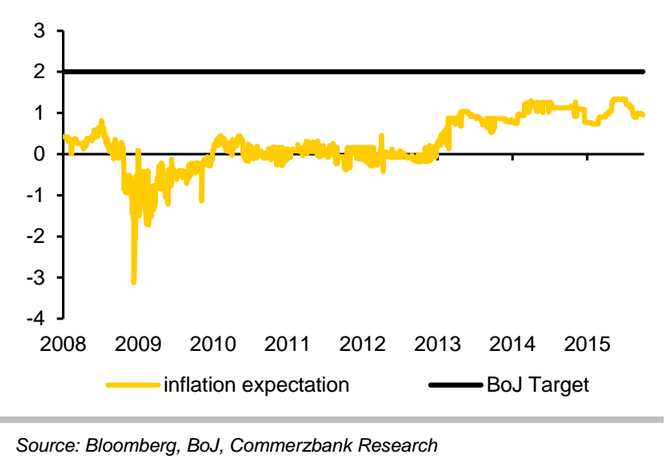

Although the BoJ is sticking with its scenario of inflation reaching the 2% target around 1H16, many economists see that as doubtful. After hovering near zero for months, the Bank of Japan's preferred inflation gauge dropped into negative territory in August. Japan's core consumer prices fell 0.1 percent in the year to August, marking the first annual drop since the central bank deployed its massive stimulus programme more than two years ago.

U.S. Federal Reserve is eyeing an interest rate hike before end-2015 and will incrementally normalize interest rates after that. Whereas in Japan any discussion of interest rate normalization must begin with the price outlook. Recently, declines in energy prices and increases in food prices have been offsetting each other, and the core CPI, has dropped to around 0% YoY, which is far from the 2% target.

"Iinflation will not reach 2%, achieving the 2% inflation target will probably require continued wage increases", says BoFA Merrill Lynch in a research note.

Amid heightening concerns over the impact of lower growth in China and other emerging markets and the decline in oil and other commodity prices could have on Japan's prices, economic recovery, or financial markets, normalization will probably be a while in coming. A worsening of emerging market economies and delays in the recovery of household consumption are also risks.

The BoJ is now purchasing about 90% of all new JGB issuance, increasing its holdings of long-term JGBs at an annual pace of ¥80tn that is more than double the net supply, but the number of potential JGB sellers is limited. The JGB curve has recently priced in about five years until interest rates start to normalize, and monetary policy is currently pushing down the 10yr JGB yield by at least 85bp.

The yen was 0.4 percent higher on the day, trading at 119.43 yen per dollar on heightened risk aversion across markets. JGB prices ended the day slightly higher in quiet trading, sending yields down by 1bp to 2bp on the day in the 7-yr and longer zone.

When can BoJ normalize interest rates?

Tuesday, September 29, 2015 11:45 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist