The Bank of Japan as widely expected kept monetary policy steady and maintained its money printing drive at the current rate on Friday, but reorganised its massive stimulus programme in an effort to advance premier Shinzo Abe's plans to boost the economy. Further, the BoJ maintained the same cautiously optimistic views as in previous meetings that growth is on track to recover, with exports improving and business sentiment at favourable level.

BoJ added several accommodative measures which can be summarised as follows:

- Extend the duration of the Japanese government bonds (JGBs) buying from 10 to 12 years from 2016

- Set up a new 300-billion-yen fund to buy more ETFs that encourage investment

- Extend eligible collateral for the central bank's provision of credit

- Extend growth lending programs by one year

- Boost the total amount of issue of each J-REIT to be bought

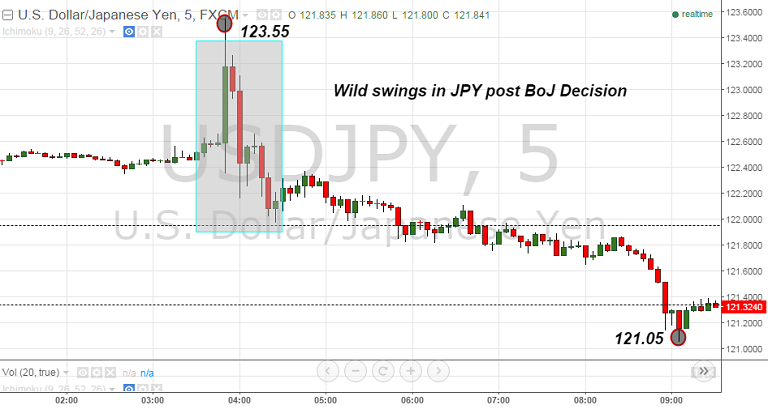

The Japanese Yen fell over 0.6 pct against the dollar and the Nikkei rose more than 2 pct in an immediate reaction to the policy decision. Markets saw the new steps as a return to the incremental policy style Kuroda had abandoned when launching his stimulus programme in 2013. This set of dovish actions may have caused the currency to drop at the start of the announcement. But as markets digested the news, yen pared losses and extended gains to 1.3 pct on day vs dollar in london trade, hitting the session's high of 121.145

At the press conference BOJ Governor Haruhiko Kuroda stressed that the BoJ's fine-tuned stimulus package should not being seen as additional easing. Kuroda said the fine-tuning will allow the bank to sustain or even expand stimulus more easily, dismissing the views of some investors that it was taken to avoid bolder steps as its bond buying was drying up market liquidity. He said the new steps do not amount to additional monetary easing as they did not address downside risks to the economy. He also said they were not directly spurred by the Fed's decision on Wednesday to raise interest rates.

Japanese Finance Minister Taro Aso said on Friday that the Bank of Japan made an appropriate decision earlier in the day to supplement its massive stimulus programme. However the changes announced are small relatively to the existing QQE programme and hence are unlikely to have any noticeable and lasting effects on the JPY.

Japanese equities finally closed down 1.90 pct at 18,986.80. The yen saw wild swings during the day. At 1040 GMT, USD/JPY was trading at 121.55, day's range being 121.06/123.55, while EUR/JPY was at 131.56.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan