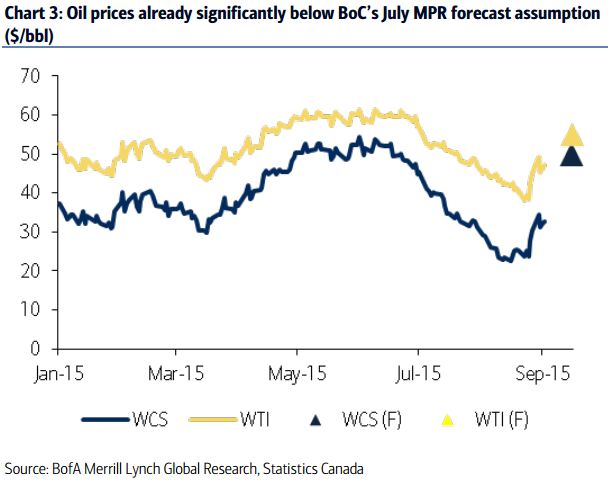

The sharp rise in oil prices off their lows over the past 10 days, better-than-expected Q2 GDP print (which matched the BoC's forecast), a second trade balance beat driven by strong non-energy exports likely reduces the risks of a September cut for BoC. A relatively neutral statement tone as a result of these developments would likely elicit knee-jerk CAD strength with USD/CAD still trading close to its recent highs despite the rebound in oil prices.

If the Fed begins normalizing this year, policy divergence will continue to support long USD/CAD stance. The high correlation between Canadian and US rates suggests that a Fed hike could lead to an unwanted tightening of Canadian financial conditions. So even if the CAD weakens, the net effect will be more muted by the rise in Canadian rates, increasing the BoC's incentive to ease further.

Bottom line, whether the Fed hikes in September or later, policy divergence still moves strongly in the dollar's favor as the BoC hikes again, supporting higher USD/CAD conviction.

"We would fade any CAD strength on the back of a more neutral statement and no cut," notes BofAML.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX