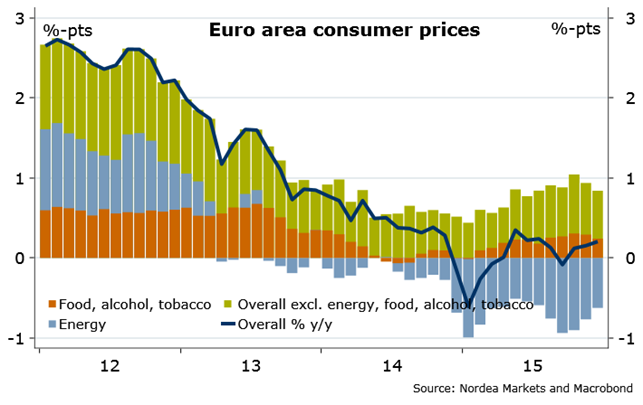

Inflation in the Euro area remained at 0.2% y/y in December. That was no surprise after the low German print yesterday. The ECB has recently shifted the focus a bit towards the core rate. The one excluding the prices for food, energy, alcohol and tobacco also remained unchanged at 0.9% (actually 0.86%).

"We expect the headline rate to rise to ½% y/y in January and to hover around that level in Q1. Still, further ECB easing measures cannot be ruled out", says Nordea Bank.

The contribution from energy prices was less negative than in November as energy prices fell more in December 2014 than in December 2015. The same effect should be visible in January pushing the headline inflation rate up to around ½% y/y.

Nothing points to a significant pick-up in core inflation. On the contrary, the inflation rate ex energy fell a tad to 0.9% y/y while service prices only increased by 1.1%, down from 1.2% in November and 1.3% in October. The point frequently made by the ECB that "signs of a pick-up of core inflation have weakened" therefore remains valid.

"We expect the headline inflation rate to hover around ½% y/y during Q1. Regarding the ECB we currently forecast no further policy easing after the substantial measures taken last year and given the ongoing recovery. However, with inflation way below target and the ECB's easing bias, further easing cannot be ruled out. The next two ECB policy meetings will be on 21 January and on 10 March. While the January meeting will most likely be for wait-and-see, March could be more interesting," added Nordea Bank.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated