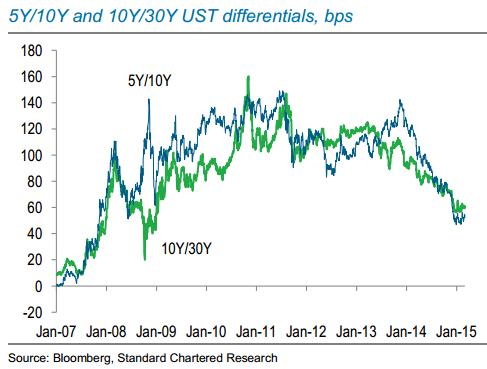

The Fed is expected to maintain its tightening bias in the near term and that the short end of the UST yield curve therefore faces upward pressure, while concerns about disinflation keep the long end of the curve low.

This in turn leads to UST yield curve flattening. In the previous rate-hiking cycle between June 2004 and June 2006, a flattening of the UST yield curve led to a steepening of the credit curve - a trend that is evident now. However, such a steepening will be short-lived, as crowded positioning in the long end will flatten credit curves and they will eventually follow the UST yield curve.

Standard Chartered notes its observations as follows:

- The upcoming rate-hiking cycle is likely to be different from the previous ones because (1) QE has been keeping interest rates low artificially and (2) the terminal fed funds rate at the end of the cycle will likely be below historical norms.

- Rates curves are already flattening in response to the impending rate-hiking cycle, and we think credit curves will follow suit. Nonetheless, we believe that carry will remain positive for long-duration bonds and curve flattening trade ideas will remain a sound tactical play.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed