NSE Nifty was trading 0.23% higher at 7226 points while BSE Sensex was trading 0.20% higher at 23763 points.

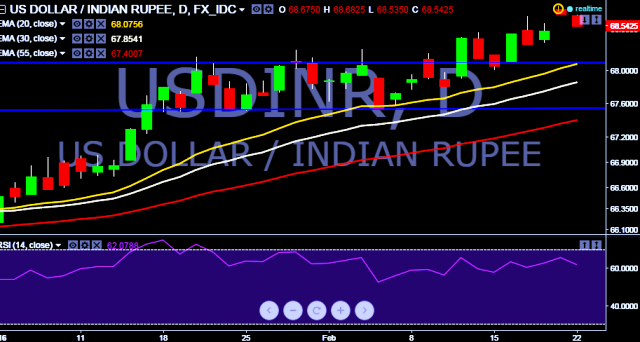

- On the other side, Indian rupee is well supported above 68.50 marks.

- India is going to release financial budget for the year 2016 on February 23.

- USD/INR intraday bias remains bearish for the moment. Intraday trading range will remain in between 68.35 - 68.68 levels.

- A daily close above 68.68 will turn the bias positive and take the parity back above 69.00 marks.

- Alternatively, current downfall will drag the parity around minor support level at 68.18 levels.

- Major resistance level fall at 68.68, 69.00 and 69.22 levels thereafter.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.