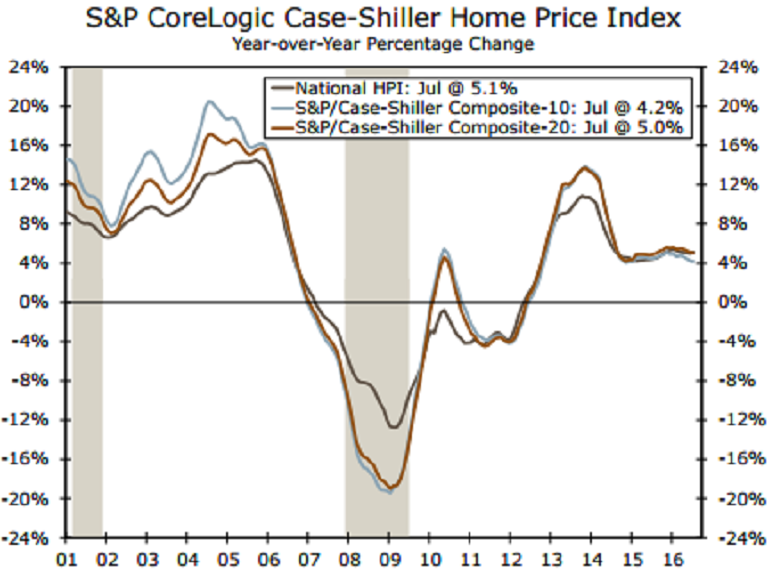

The United States national home prices edged higher during the month of July, strengthening probabilities of a December interest rate hike by the Federal Reserve. However, price appreciation in the 20-City Index has shown signs of cooling off.

The S&P CoreLogic Case-Shiller composite index of 20 metropolitan areas rose 5 percent in July on a year-over-year basis, retreating from the 5.1 percent climb in June against a 5.1 percent increase according to a Reuters poll of economists.

Further, monthly price declines in Chicago, New York and San Francisco have contributed to some of the reported softness in the 20-City Index. Affordability remains a key challenge, however, as home price appreciation continues to outpace wage growth.

Also, Portland, Seattle and Denver continue to see prices rise sharply. On a year-over-year basis, the three cities have reported nation-leading gains in each of the past six months.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off