The turmoil in China has intensified the debate within the U.S. Federal Reserve over whether the inflation outlook will be strong enough to justify higher interest rates as soon as September. While select officials at the Fed see short-to-mid-term acceleration in inflation as sufficiently robust to support a cautious and gradual increase in borrowing costs, the overall picture is more complicated.

At the July FOMC meet there was a notable lack of consensus among policymakers on the timing of the first rate hike. The minutes of that meeting contained several references to concerns about the impact of the strong dollar and declines in commodity prices on the inflation outlook. The developments in August are not likely to have increased the doves' confidence in the inflation outlook.

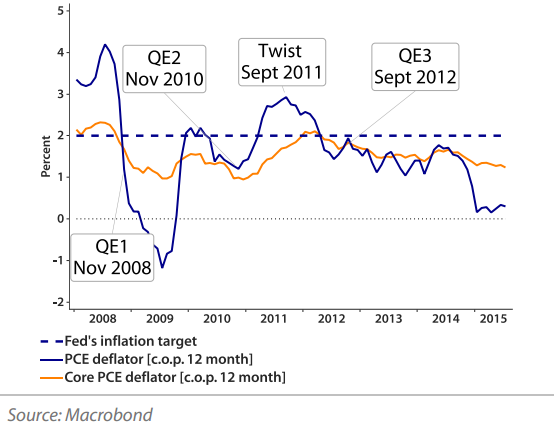

The most recent inflation figures for July have shown the weakest annualized increase in prices since March 2011. The Fed's preferred measure of inflation, the PCE deflator, remained at 0.3% y/y in July, but the core measure fell to 1.2% y/y. This suggests that it may take longer for the headline figure to return to the Fed's 2% target. The slowdown of the Chinese economy, the devaluation of the yuan against the US dollar, and the worldwide decline in commodity prices could further delay the return of US inflation to its 2% target.

"With this lack of consensus on the timing of the first rate hike, and the many doubts about the inflation outlook, we continue to think that a September rate hike is less likely than a first rate increase in December", says Rabobank in research note to its clients.

Policymakers are struggling to get grips on the clouded outlook from the People's Republic of China, trying to figure out how significant the weakness in China will prove to be - in part because of the opacity of the country's data and complexity of its decision-making processes.

However, arguments for a September hike are being supported by strong domestic growth figures and optimism about the jobs market. The second estimate of Q2 U.S. GDP came in at 3.7%, well above the first estimate of 2.3%. Combined with the strong durable goods orders for July, business investment appears to be back on track. The encouraging personal spending and income data for July suggest that growth in consumer spending should remain solid in Q3.

"Although the inflation outlook is likely to delay the Fed's first rate hike beyond September, the domestic momentum of the US economy supports our view that the first hike will take place before the end of the year, most likely in December", points Rabobank.

The euro rose for a third straight day against the dollar on Tuesday, as expectations that the U.S. Federal Reserve will raise interest rates next week faded. Euro was 0.1 percent higher at $1.1182 while the Sterling was half a percent up at $1.5345.

U.S. inflation outlook turns cloudy, rate hike most likely in December

Tuesday, September 8, 2015 10:31 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand