Total US housing starts rose 9.8% m/m in June, following the recent surge in permits. The June increase was driven by multi-family starts. Single-family starts were down modestly, as a decline in the West offset gains elsewhere. Permits rose 7.5% in June and are up 30% y/y, indicating that the housing market recovery still has legs. Retail sales disappointed with the weakness extending across most categories. However, the June decline follows solid increases across many categories in May and did not materially change the outlook for consumption.

Barclays notes:

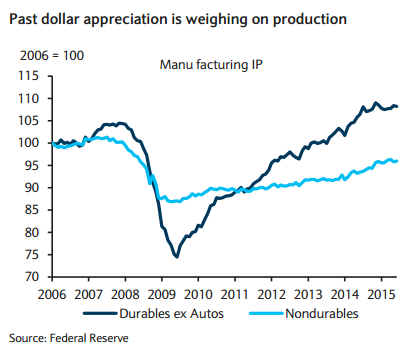

- Industrial production was broadly in line with expectations. We discount this strength somewhat as manufacturing production continues to show weakness.

- As of now, we view the recent flatness as a response to past dollar appreciation. As these effects wane, we expect production to resume its positive trend.

- CPI data came in largely as we had expected, with headline prices rising 0.3% m/m in June supported by a solid 0.2% m/m core print.

- Core inflation rose to 1.8% y/y, reinforcing our view that core prices should gradually move toward 2 percent this year. Core goods prices declined modestly and core services inflation continued to rise.

- We expect the recent decline in oil prices to weigh modestly on headline inflation.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX