The US federal government reported a monthly deficit of $64.4bn in August, modestly wider than CBO projections ($62bn) and $64bn narrower than in August 2014. A large portion of this decline, however, was due to the time shifting of payments, according to CBO analysis. Adjusting for these calendar effects, the monthly deficit would have narrowed just $4bn from the year prior. Receipts were up 8.5% y/y, driven almost entirely by growth in income and payroll taxes withheld from workers' paychecks. Spending was down 14.8% y/y on a reported basis, but up 4.3% on a CBO calendar-adjusted basis.

The growth in adjusted outlays was driven primarily by mandatory spending on entitlements. Spending on Medicaid, Medicare, and Social Security was up $10bn, while healthcare outlays related to the Affordable Care Act totaled $7bn. A $5bn decline in Department of Defense outlays helped to partially offset this spending growth.

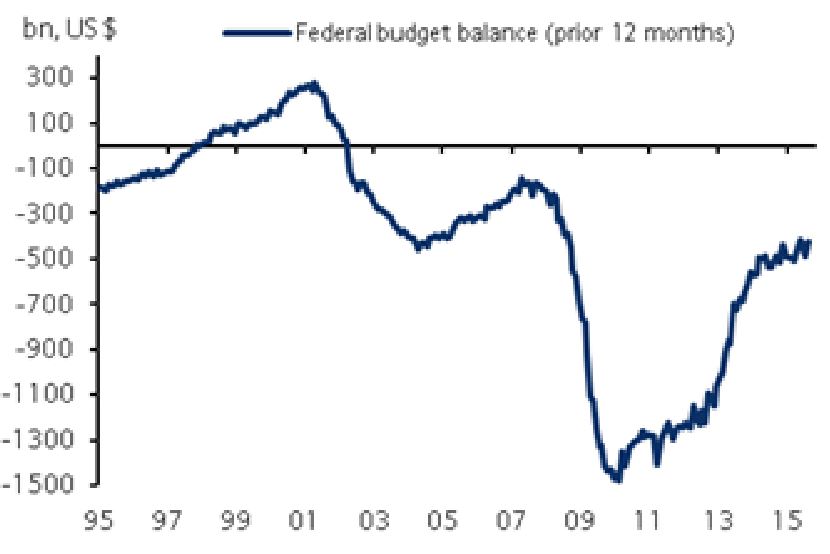

The August data bring the 12-month rolling deficit to $424.2bn, down from $488.4bn last month. Next month's data for September will mark the close of FY 2014. We look for the annual budget deficit to have totaled $425bn, in line with the CBO estimate of $426bn.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX