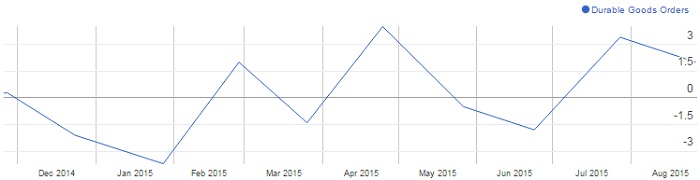

US durable goods orders, despite its own volatility provided glimpse of hope against assumption of global economic slowdown and US economy may not be vulnerable to slowdown in China.

A pickup in growth in World's largest economy will certainly provide hopes when the second largest China is expected to slow down further. Though it is likely to boost overall optimism, it may not be as much as good news for emerging economies who have greater exposure to China than US.

- Goods orders climbed 2% in July from June, beating economists' expectation of 0.4% decline and stripping the airline orders, it jumped 0.6%, again beating the forecast of 0.3%.

Despite its notorious volatility it is of high importance as it's taken as a barometer for business investment and any better data before FED meeting in September, likely to boost rate hike bets, which has declined sharply over the past couple of days.

August data will be of much more prominence since it would provide, how businesses react over current turmoil.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?