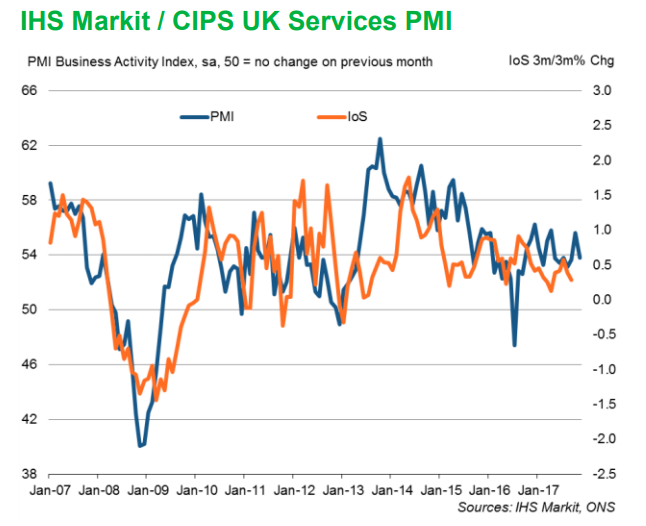

UK Markit Services PMI, a closely-watched survey of activity in U.K.'s dominant service sector disappointed in November. Data released earlier today showed IHS Markit's purchasing managers' index for the services sector fell to 53.8 in November, down from 55.6 in October and missing expectations of a reading of 55.

Details of the report showed although optimism in the sector increased, growth in business activity fell off its six-month high, while increases in volumes of new work eased. Rate of staff hiring was the joint-slowest since March. Heightened economic uncertainty and ongoing pressure on margins from sharply rising input costs weighed on confidence.

“Optimism for the future was sustained and improved slightly but this is nothing to write home about. Though any uplift in sentiment is always welcomed, the levels of confidence were far from those seen during the highs of 2013-2016.” said Duncan Brock, Director of Customer Relationships at the Chartered Institute of Procurement & Supply.

Input cost inflation remained close to its strongest for six years, and businesses passed these increases on to consumers at the fastest rate since February 2008. Prices charged by services companies picked up for a fifth straight month in November. PMI surveys point to the largest monthly increase in average prices charged for goods and services since August 2008.

"However, despite the weaker service sector expansion, the latest survey data indicate that the economy is on course to enjoy robust growth in the fourth quarter. The survey data are so far consistent with the economy growing at a quarterly rate of 0.45 percent in the closing months of 2017," said Chris Williamson, IHS Markit's chief business economist.

GBP/USD erased upbeat construction PMI led gains, trades 0.43% lower on the day at 1.3419 levels at around 1100 GMT. Technical indicators on daily charts are turning bearish. RSI has turned south from near overbought levels and Stochs are on verge of a bearish rollover. Price action has broken below 5-DMA at 1.3460 and is on track to test next major support at 1.3285 (20-DMA). We see strong resistance at 1.3550 and any convincing break above will take the pair to next level till 1.3600/1.3700 level.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest