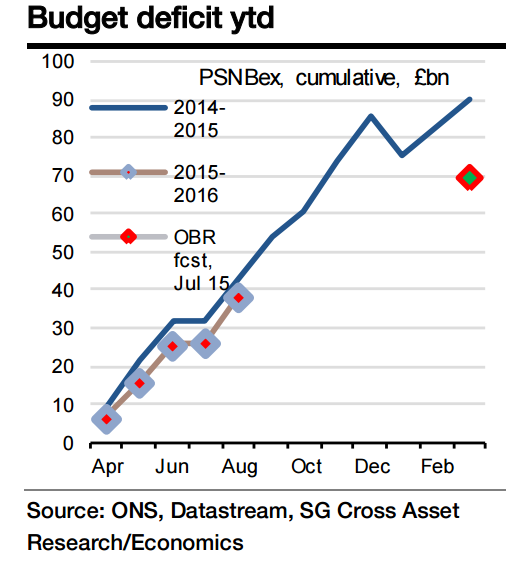

The monthly evolution of the budget deficit is highly erratic. In the first three months of the fiscal year, the PSNBex measure fell by a total of £6bn compared to a year earlier but then in the following two months was £1.6bn worse. So the year-to-date (August) improvement is £4.4bn. However, for the OBR projections for the full year to be met, the improvement would have to have been twice that.

The quality of the data on some of the key inputs is poor until quite late in the year so we should not be surprised at this volatility. Moreover, this also means that we should be cautious in interpreting the year-to-date performance as implying that the full year projection will be missed.

"For September we predict that the deficit will be the same as a year earlier at £11.0bn," notes Societe Generale.

UK public finances improvement to stall temporarily in September

Monday, October 19, 2015 8:54 PM UTC

Editor's Picks

- Market Data

Most Popular

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off