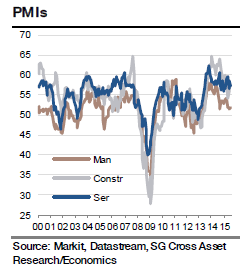

The suite of PMIs should indicate that the momentum of U.K. economic activity remains strong but with differing performance by sector. Of the three sectors, manufacturing looks the most vulnerable to changes in global economic trends. There seems to be a slowdown in world trade which should be felt in export orders.

"Domestic demand remains firm but the external factor should lead to a minor fall in the manufacturing PMI from 51.9 to 51.5. The overall result in construction sector should be dominated by the rising housing sector and so we expect an increase from 57.1 to 57.7", says Societe Generale.

The services PMI is volatile on a month to month basis dipping from 58.5 in June to 57.4 in July. A bounce is expected to 58.3 in August and the overall composite PMI is likely to rise slightly from the July reading of 56.6, adds SocGen.

U.K. economy strong momentum continues

Monday, August 31, 2015 7:46 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX