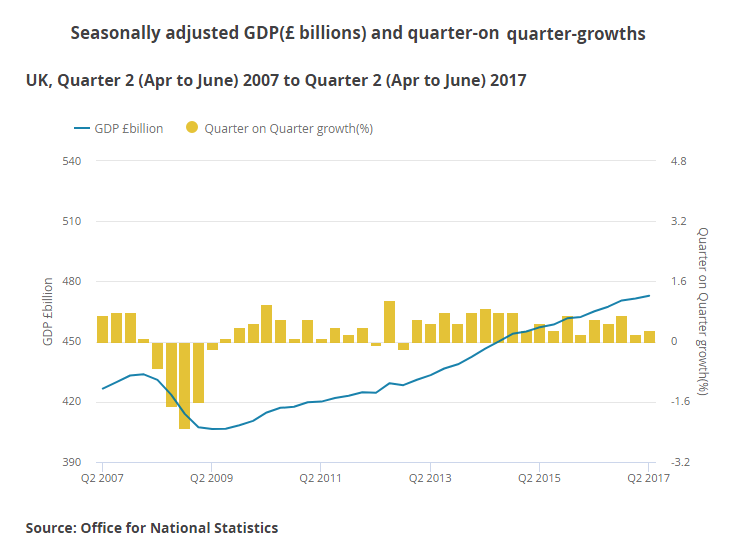

UK economic growth nudged up in the second quarter of 2017 after a “notable slowdown” seen in the first half of the year. Official data for gross domestic product published by the Office for National Statistics (ONS) showed that UK gross domestic product rose 0.3 percent in the three months to June, up slightly from the 0.2 percent rise seen in the previous quarter.

The data was in line with consensus expectations and taken together with Q1 data suggests that the pace of economic growth slowed sharply in the first half of 2017. The second quarter growth was below the 0.4 percent expansion anticipated by the Bank of England (BoE) and raises downside risks to 2017 GDP outlook.

Details of the report showed growth in UK continues to be led by the dominant services sector which expanded by 0.5 percent q/q in Q2, while contractions were recorded in both the industrial and construction sectors. Manufacturing output shrank 0.5 percent compared to a 0.3 percent rise in the first quarter. Construction output also paid back much of the 1.1 percent gain seen in the first quarter, declining some 0.9 percent.

The main focus now will be on next week’s BoE monetary policy announcement & inflation report. Today's data suggests possibility that the central bank will revise down its forecasts for the economy next week from the 1.9 percent growth it has currently penciled-in. IHS Markit is currently forecasting just 1.4 percent growth, while the IMF has just downgraded its expectation to 1.7 percent.

“The confirmation of the lackluster performance of the economy so far this year surely also diminishes the chance of an interest rate hike any time soon, especially as growth prospects for coming months have become increasingly skewed to the downside", said Chris Williamson, Chief Business Economist, IHS Markit.

Pound dented following the publication of UK’s GDP figures. GBP bulls regained momentum and pushed GBP/USD back towards 1.3050 levels from session lows of 1.30. Cable was trading at 1.3055 at the time of writing, up 0.24 percent on the day. Technical indicators on daily charts support upside in the pair. Markets await FOMC policy decision due shortly for further impetus.

FxWirePro's Hourly GBP Spot Index was highly bullish at 165.433 levels. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns