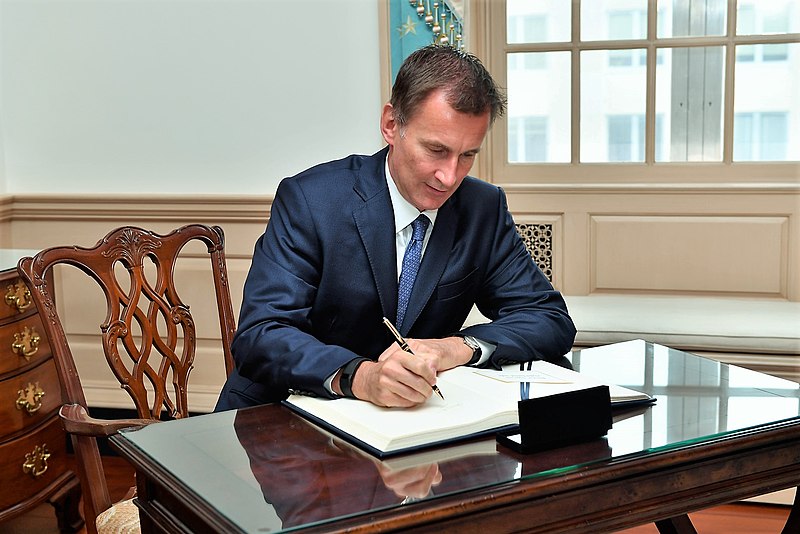

British finance minister Jeremy Hunt said he plans to raise an additional £32 billion a year in tax while scaling back the energy price cap plans of the government. This comes amidst the backlash that Prime Minister Liz Truss has received for her economic plan.

Hunt announced the tax changes Monday that can see an additional £32 billion in tax per year. Among the changes that were listed by Hunt include an indefinite suspension to the tax cut plan that was set to fall in April next year under Truss’s original economic plan that triggered financial markets.

Hunt also said the large energy price cap by the government would only last until April next year, after which the government is expected to look for ways to assist the most low-income households.

Hunt also scrapped the cut in dividend tax, creating a new VAT-free shopping scheme, freezing alcohol duty rates, and new rules for people who are self-employed, all of which are under Truss’s original plans.

“Taken together with the decision not to cut corporation tax and restoring the top rate of income tax, the measures I’ve announced today will raise every year around £32 billion,” said Hunt, adding the plans to cut the rate of National Insurance, as well as the cut to the stamp duty tax on property purchases, will proceed.

Hunt was also pressed during a parliamentary debate on whether he would recommit to the government’s pledge to raise publicly-funded pensions by the highest of income, inflation, or 2.5 percent. Hunt said he could not commit.

“I’m very aware of how many vulnerable pensioners there are and the importance of the triple lock…but I’m not making any commitments on any individual policy areas,” said Hunt. “Every decision we take will be taken through the prism of what matters most to the most vulnerable.”

Hunt also said that the economic forecasts that the country’s economic watchdog OBR is set to publish by the end of the month that will show the government’s debt dropping as a proportion of income in response to a question by a lawmaker.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Sydney Braces for Pro-Palestine Protests During Israeli President Isaac Herzog’s Visit

Sydney Braces for Pro-Palestine Protests During Israeli President Isaac Herzog’s Visit  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Bangladesh Election 2026: A Turning Point After Years of Political Suppression

Bangladesh Election 2026: A Turning Point After Years of Political Suppression  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Israel Approves West Bank Measures Expanding Settler Land Access

Israel Approves West Bank Measures Expanding Settler Land Access  Trump Congratulates Japan’s First Female Prime Minister Sanae Takaichi After Historic Election Victory

Trump Congratulates Japan’s First Female Prime Minister Sanae Takaichi After Historic Election Victory  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  Nicaragua Ends Visa-Free Entry for Cubans, Disrupting Key Migration Route to the U.S.

Nicaragua Ends Visa-Free Entry for Cubans, Disrupting Key Migration Route to the U.S.  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks  Ghislaine Maxwell to Invoke Fifth Amendment at House Oversight Committee Deposition

Ghislaine Maxwell to Invoke Fifth Amendment at House Oversight Committee Deposition  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project