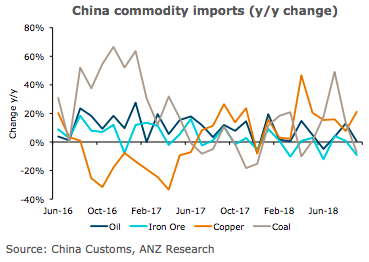

Escalations of trade war worries weighed on China’s commodity imports during the month of September, with volumes for oil, natural gas, coal and soybeans falling from the previous month. On a seasonal basis, growth rates also trended lower, although this may be more reflective of relatively high imports this time last year.

Some of this weakness may have been a result of interruptions to trade flows as the trade war escalated. This is expected to be relatively short lived, with imports to remain strong in Q4. Crude oil imports fell 3 percent from August to 37.21mt (~9.1mb/d) in September as demand from independent oil refiners eased amid rising prices, according to the latest report from ANZ Research.

While refinery utilisation rates have been rising in recent weeks, the rise in prices has no doubt eroded their profit margins. The country’s insatiable appetite for natural gas also waned, with imports falling nearly 2 percent m/m. However, we suspect much of the weakness was as a result of uncertainty around tariffs on US imports.

Iron ore imports rose 4.6 percent m/m to 93.5mt as steel makers restocked amid signs of stronger demand from infrastructure and housing sectors. Planned curbs on steel production over the upcoming winter also appear to have played their part. Despite hitting its highest level in four months, imports were down 9.1 percent y/y.

Ample stockpiles of coal at utilities also saw imports ease. Copper bucked the trend, with imports surging 21 percent y/y to 521mt in September. This was also up 24 percent from the previous month.

This backs-up other data which has suggested fundamentals are strong, such as falling inventories and rising premiums. Meanwhile, disruption to trade due to US sanctions on Russia continues to benefit Chinese aluminium exporters, with volumes rising 37 percent y/y in September, the report added.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality