Expectations for near-term economic growth have been scaled back as the rhetoric surrounding the trading relationship with China have heated up, while the heightened speculation about a trade war has sent the financial market reeling, according to a recent research report from Wells Fargo.

Pronouncements by both sides remain just words at this point. There is still plenty of time to reach a settlement before any actual trade restrictions would take effect. Estimates for first quarter real GDP growth have been ratcheted down for a more mundane reason – the weather. The first quarter saw more than its usual share of winter weather. The snowier weather weighed on consumer spending and construction.

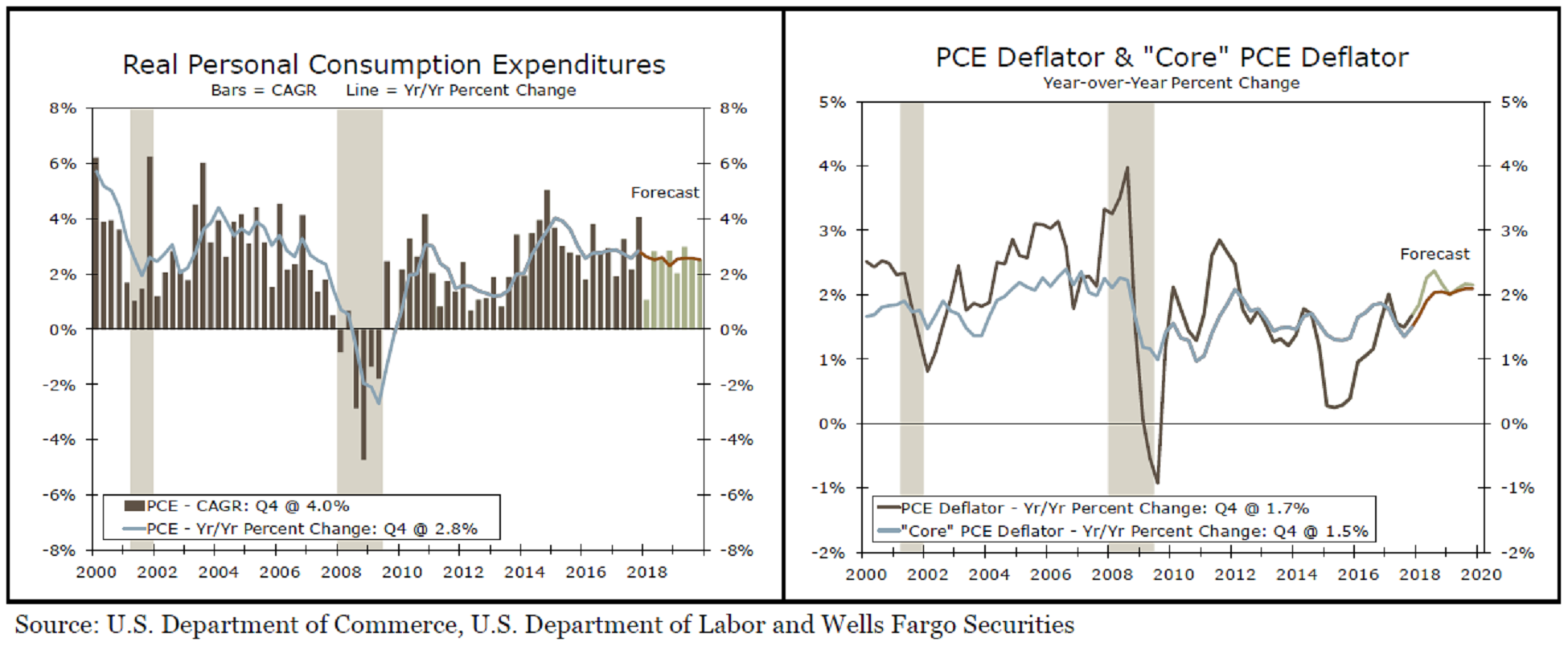

The trade deficit also widened during the quarter and it is expected to subtract meaningfully from overall GDP growth. The apparent weak start to 2018 repeats an all-too-familiar pattern, where the first quarter has proven to be the weakest quarter of the year.

Growth is expected to bounce back this spring, however, and look for real GDP to average close to 3 percent through the end of the forecast period. Fiscal policy is now a potent tailwind and should boost consumer spending, business fixed investment and the public sector.

"The trade dispute and softer economic data slowed the rise in interest rates. We are still looking for three more quarter-point rate hikes from the Fed and look for the yield on the 10-Year Treasury Security to end the year around 3.20 percent," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022