James Carnell, Author

In times of crisis, smart investors often have two things that others do not: safe-haven assets that ensure the stability of their portfolio and cash to buy up new assets which can suddenly be acquired at knock-down prices. They often exit markets just before they become overheated to convert their cash into assets with solid intrinsic value, such as real estate.

However, for retail investors, the process of identifying, analysing and deciding which opportunity to go for can be cumbersome and confusing. So we’ve done the hard work for you and scanned the market to identify the top 10 real estate investment opportunities in Switzerland in 2020.

What makes our research different?

We believe the traditional criteria of analysing real estate opportunities (e.g. using location, asset class, yield and transaction costs, etc) to be insufficient (although still important). Instead, we examine these investments through the prism of a new paradigm. In this new world, we believe that most of the assets that are currently easily accessible to us are overvalued due to information symmetry as well as a decade of low-interest rates and quantitative easing. We believe such assets to be susceptible to massive losses should the market realise their true intrinsic value.

Instead, under this new paradigm, we return to the fundamentals of a business and look at them through some simple, obvious and yet often overlooked criteria:

-

Demand is unlikely to fall during the economic downturn, creating an inherently stable macroclimate

-

The asset is not publicly traded and less susceptible to emotional sell-off in the market

-

Fairly valued with a price-to-earnings ratio below 20

-

Have certain competitive advantages and barriers to entry, easing the pressure on pricing

-

Easy to operate, reducing the reliance on experts

-

Consistent profitability

-

Diverse revenue streams

Using these additional non-conventional criteria to complement your investment analysis can significantly reduce the possibility of permanent capital loss during turbulent market conditions. We have thus used them to examine each opportunity. They offer a comprehensive insight into the risk-reward profile and thus enable investors to make the most informed decision.

The Top Swiss Real Estate Investments

We screened hundreds of different real estate opportunities and applied a series of stringent tests before arriving at our shortlist of ten. In our view, these are the very finest opportunities available to investors in Switzerland today.

1. CS Real Estate Fund Hospitality

Website: link

The CS Real Estate Fund Hospitality is a mutual fund that focuses on the hospitality and healthcare sector in Switzerland. The portfolio includes serviced residential apartments, hotels, convention centres, and healthcare properties. The fund holds properties directly and investors benefit from the increase in valuation from the underlying property holdings.

Key advantages

-

Geographical and asset sub-class diversification across Switzerland

-

Focused on a growing market sector

Key risks

-

Global and local economic downturn

-

Falling population

-

Subject to investor sentiment

-

Highly liquid and owned by other ETFs, thus has a risk of a major sell-off

Verdict: A Swiss-focused property fund that targets a specialist sector. Unfortunately, the fund has underperformed the benchmark index since they began trading, indicating a change in management may be overdue.

2-3 Le Bijou equity and bond investments

Website: link

Le Bijou is the leading luxury travel accommodation rental service in Switzerland. Operating in prime locations in all major Swiss cities, Le Bijou properties fuse first-class design and infrastructure with personalized services and technology to provide an unparalleled guest experience. As a result, the luxury hospitality provider has been profitable since day one.

For bondholders, investors lend capital to Le Bijou for the leasing and refurbishment of selected properties. In return, they are rewarded with a fixed yield (between 3 to 6%) due to the profitability of the business.

For equity holders, investors inject capital into the operating entity and benefit from the profit (in the form of dividends) it generates, on average up to 7% and more

Key advantages

-

Fairly valued - P/E under 20, not subject to market emotion

-

Diversified demand structure

-

High profitability - a good margin of safety

Key risks

-

The possibility of falling visitor volume in Switzerland (e.g., due to global health or economic crises) can lead to a high vacancy rate. However, Le Bijou mitigates this through diversifying customer base (e.g., by targeting high-net-worth leisure travellers as well as business ones)

Verdict: A premium investment product with a proven track record of delivering consistently strong profit to bondholders. Perhaps the only drawback of this asset is its availability - as investors need to be interviewed and approved before being accepted into the investment club (the company emphasises the value of its investor community).

4. CS (CH) Swiss Real Estate Securities Fund

Website: link

An ETF that tracks the SXI Swiss Real Estate® TR Index and is diversified across the residential, commercial and industrial sectors. Being a public ETF, the valuation of this asset is constantly changing and under review. As a result, it is very susceptible to the shifting sentiments of investors. It is also considered to have inflated values thanks to the twin effects of quantitative easing and ultra-low interest rates, deployed since the Great Recession. Being an index-tracker, it performs no fundamental analysis on its underlying holdings, thus it is subject to asset-specific risks.

Key advantages

-

Instant exposure to a wide range of Swiss real estate assets

-

Passively tracking an index and thus requires no active management

Key risks

-

Publicly traded and owns publicly traded assets, so is subject to investor and market sentiments

-

Performs no fundamental analysis of the underlying assets

-

Vulnerable to economic downturns

Verdict: A good ETF to gain instant exposure to a real estate index in Switzerland that spans across multiple asset classes and offers high liquidity. However, it is expensive to run and also is subject to key risks that are overlooked.

5. UBS AST Immobilien Schweiz

Website: link

A close-ended property fund that invests primarily in residential estates. Redemption is available on a monthly basis. Known for its stable performance and low volatility. This is a close-ended fund that does not trade openly during market hours, therefore it is not suitable for investors that demand instant liquidity. It is a relatively new fund and its cumulative 5-year performance was 6%, which is well below the benchmark. This indicates a problem with fund management.

Key advantages

-

Close-ended and thus much less subject to market volatility (although not entirely removed)

-

Direct investment in Swiss residential properties, which is a stable sector

-

Well-diversified across most Swiss cantons

Key risks

-

Lower liquidity

-

Poor historical performance

-

Relatively high rental default rate (6.7% vs sub-5% in the industry)

Verdict: A close-ended fund for patient investors. It is trading at a slight discount relative to its fair value. Its true potential may not be realised unless a change in management is actioned.

6-7. Crowdhouse equity and debt financing

Website: link

A diversified platform that focuses primarily on crowdfunding real estate investing in Switzerland. It specialises in multifamily houses in more affordably priced areas - usually regions away from big cities, where the prices are lower; thus a small investor can diversify across a bigger set of properties with the same amount of money. It searches, locates, negotiations and organises the purchase of properties on behalf of investors as well as handling the daily management.

The business has 3 key pillars:

-

Buying a property outright (either as owner-occupier or investor)

-

Buying a partial stake in the property (as an investor)

-

Selling a property to Crowdhouse

It offers both equity and debt investing opportunities.

Key advantages

-

Instant and target exposure to a wide range of residential (and some commercial) properties in Switzerland

-

Ability to create a diversified portfolio by yourself

-

Higher yield than many property mutual funds

Key risks

-

Properties located in city outskirts have lower demand and are at risk of demographic or local economic changes, leading to the risk of “tenant defaults”.

-

Limited liquidity - possible to sell your shares only to other similar investors

-

Management fees between 3-5%, although the company charges them only if the property performance matches the planned performance

Verdict: A relatively new concept of pooling retail investor capital into properties through the use of technology, it delivers a healthy yield for investors however its potential is limited by the high entry barrier (CHF 100,000+) and the exorbitant management fees. The risk is further amplified by investing in less-than-prime properties.

8. Foxstone

Website: link

A newly established crowdfunding business that enables investors to invest in Swiss residential projects. It offers both equity and bond-based investment options. Investment performance reporting is conducted on a quarterly basis.

Key advantages

-

Instant and target exposure to a wide range of residential properties in Switzerland

-

Low entry barrier (minimum investment amount is CHF 10,000)

-

Low management fees (0.05-0.25%)

Key risks

-

Lower liquidity (equity resale can happen between willing buyers and sellers; bond must be held until maturity)

-

Relatively new to the block with a limited project selection

-

High initial fees at 3%

Verdict: An easy-to-enter platform that offers a limited property selection, it can be used to supplement investors’ main portfolios. The low yearly management fee makes it an attractive option given the right investment project.

9. CS Real Estate Fund Green Property

Website: link

A niche fund that invests primarily in commercial properties (with some mixed and residential projects). Its core focus is based on the environmental sustainability of the property and utilises metrics from 5 key areas (utilisation, infrastructure, energy, materials and life cycle) as a benchmark to assess their performances.

Key advantages

-

Exposure to commercial and mixed properties across Switzerland

-

Appealing to environmentally-conscious investors

-

Relatively low cost

Key risks

-

A niche market segment that is thinly traded therefore pricing volatility may be higher

-

Focused primarily in convention centres, which limits the overall size of the fund

Verdict: A quite specific fund that appeals to a selected group of investors. As the green agenda becomes more prominent in the coming years, this fund may see its true potential being realised.

10. Swisscanto Swiss Commercial FA CHF

Website: link

This is a classic Swiss commercial property fund that seeks to return a stable yield to investors by investing in long-term commercial properties. It fills up the properties with stable tenants and returns cash to investors in the form of rent. The fund is well-distributed across Switzerland and uses leverage to enhance return.

Key advantages

-

Direct and almost-exclusive exposure to the Swiss commercial property market

-

Stable and acceptable dividend yield

-

Location is diversified across the entire country

Key risks

-

Risk concentration in terms of the asset class

-

Slightly higher tenant default ratio (6%+) than average

-

Unclear on the exact portfolio composition

Verdict: This is a fund that targets a specific asset class with a clear objective of returning frequent and stable income to investors over a long-term time horizon. The overall performance is acceptable however lags slightly behind the benchmark, which makes the after-fee performance questionable.

11. Buying land (a bonus one!)

Website: Various, this is an example.

Also known as landbanking, this is perhaps the simplest, oldest and yet most overlooked option - investing in the underlying resource that all the other opportunities are built on - land. Being a finite and non-renewable resource in the face of the growing population, its availability will only become more scarce and thus value will grow higher.

Key advantages

-

Easy to understand

-

Market size is increasing

-

Lots of opportunities and developmental potentials

Key risks

-

Large capital commitment

-

Difficult to leverage

-

Must have access to specialist knowledge to develop the land

Verdict: This is a specialist investment opportunity with the most potential for reward. But investors are unlikely to reap much yield benefit as the market for land rental is practically non-existent. However, the real money lies in the developmental potential of the land and the ability to sell it on (once developed or the relevant permissions have been obtained) for ten or twenty times the initial outlay.

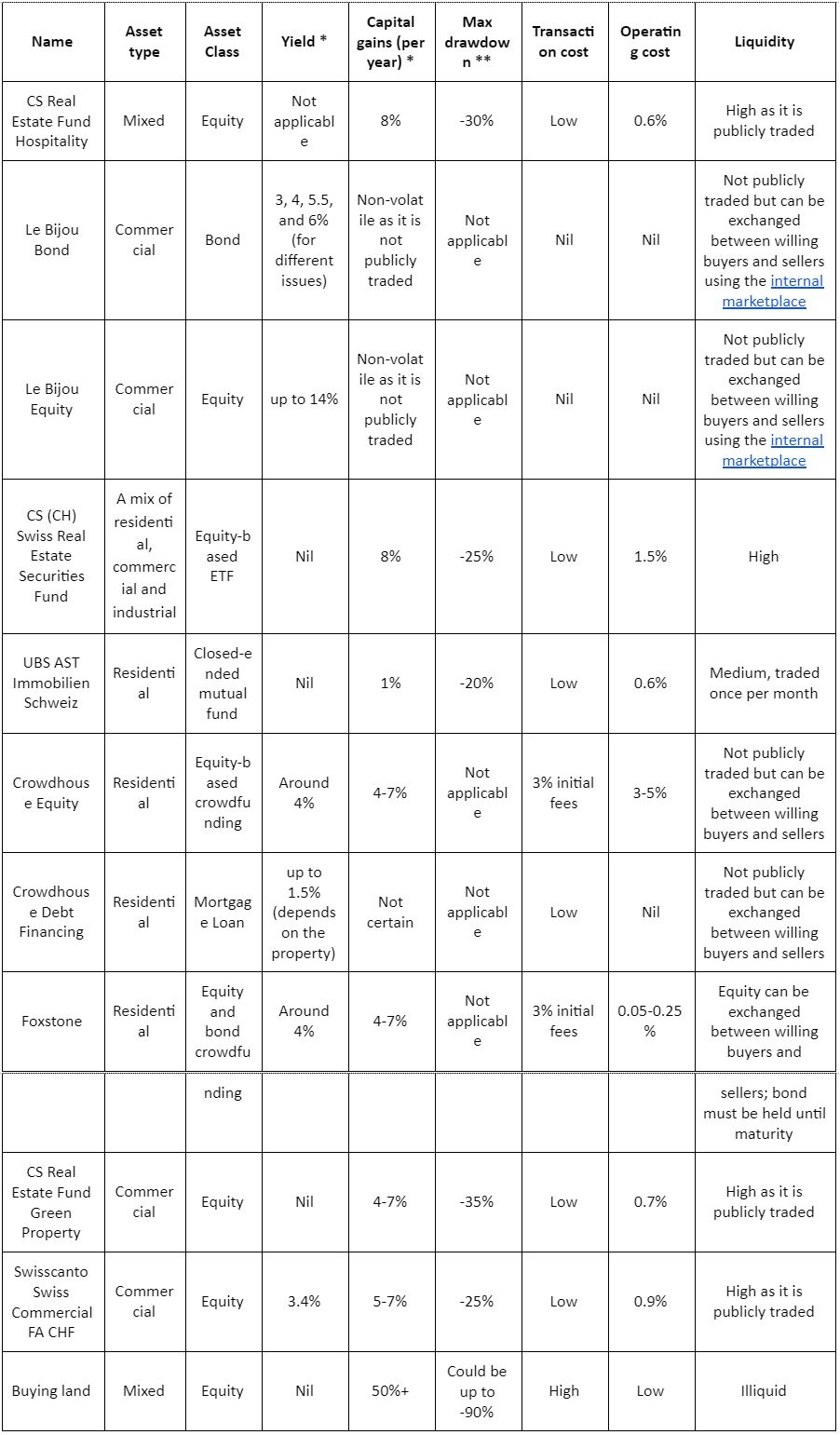

A quick summary of the Top 10 opportunities

* historical data for the 2019 calendar year; for non-public investments (like crowdfunding) that do not have a clearly defined valuation, we have taken average Swiss real estate market growth, which was 7.39% on average if calculated on the last 50 years period, and below 4% if calculated for the last 10 years - SNB data. This parameter can’t be easily measured for private equity and private bonds.

** Max drawdown shows how much an investor could lose if he bought the instrument at its historical peak and sold at its historical rock bottom. Although this situation is unlikely, it gives a very good proxy to compare the volatility of different instruments and to understand whether the investor is psychologically prepared to put a significant portion of his capital in this type of instrument. It is calculated on historical data since the inception of the given investment instrument. This concept is not applicable to non-publicly traded companies.

Looking forward

Real estate is an asset with a proven track record of returns. Being tangible and physical with inherent values, as well as the rising population and growing urbanization, it will prove to be a valuable addition to your portfolio for years to come. The key is to achieve a balanced risk-reward profile so that you are receiving the maximum return for a given level of risk.

This article does not necessarily reflect the opinions of the editors or management of EconoTimes

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment