South Korea’s NFTBank will unveil an upgraded version of its current platform that combines blue-chip NFTs and sells them in the form of funds.

The said platform, dubbed ‘NFTBank 2.0’, will also service complex NFT sales on behalf of clients.

NFTBank’s founder and CEO Kim Minsu claims that satisfaction with their service is high since the accuracy of artificial intelligence’s (AI) algorithms is about 80-90 percent.

Kim added that they can analyze big data to suggest the best time to sell specific NFTs.

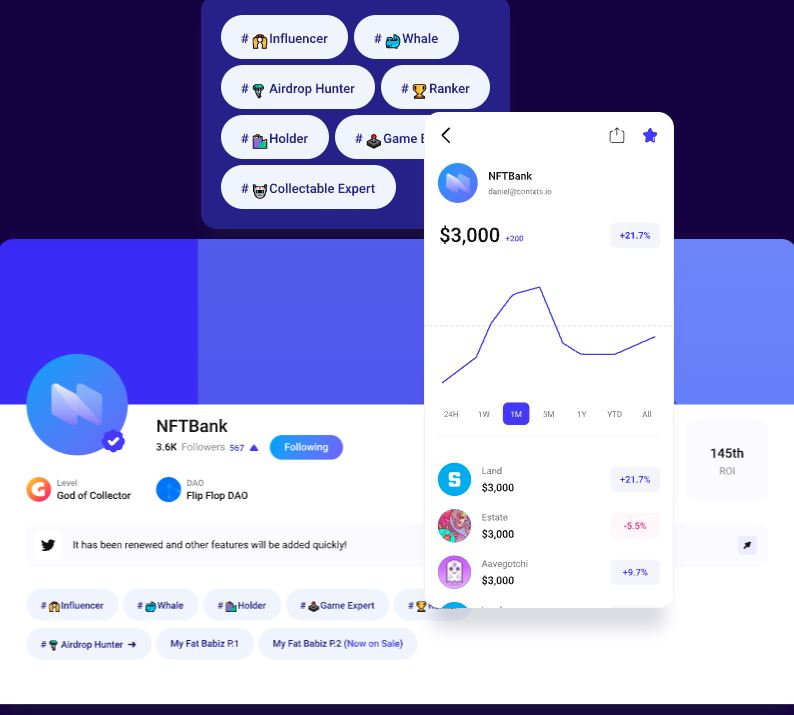

NFTBank offers a service that shows clients’ NFT transaction records, portfolio, and investment profits similar to those offered by financial asset management platforms such as Banksalad and Toss.

The company also analyzes NFT asset values in real-time, attracting many users.

Assets owned by NFTBank clients soared from 22 billion won as of end-2020 to 2.3 trillion won as of Sept. 28.

Kim said NFTBank was able to attract more customers with market talk of its “excellent service.”

Of NFTBank’s clients, 80 percent are from the US and 10 percent are from Europe.

Kim is hoping that more South Koreans join the NFT movement as its value is high and acts as a financial system in cyberspaces such as metaverse.

The market capitalization of the top 100 NFTs in the Ethereum blockchain family is at $14.3 billion as of end-August.

The total actual market is estimated to be much larger.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record