There are growing concerns whether the slowdown in China can bring the world economy -having barely recovered from the 2008 global financial crisis- to its knees once again. The knock-on effects from a slowdown in China are, unfortunately, extremely hard to gauge. Slowing growth in the emerging markets centred on China not only hits eurozone exports but also has an appreciable negative impact on eurozone business sentiment and leads to a scaling back of investment and employment plans.

China has become one of the EU's key external trading partners in goods. It ranks 2nd overall in terms of total trade and in particular has been a key source of demand for exports in recent years. Despite some tensions and trade disputes the two countries have seen a sharp rise in their interconnectivity over the past few years.

"There is the very real risk that slowing growth in the emerging markets centred on China not only hits eurozone exports but also has an appreciable negative impact on eurozone business sentiment and leads to a scaling back of investment and employment plans," says Howard Archer, economist at IHS Securities.

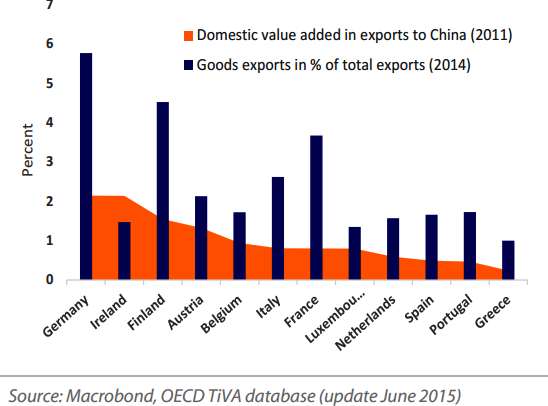

Looking through the European lens, it is noted that whilst goods exports to China have grown rapidly over the past decade (particularly from Germany and France), they still take only a small proportion of overall exports. Corrected for re-exports and other activities that do not add any domestic value, the importance of China for most of the eurozone is still rather slim (2.1% of GDP in Germany in 2011).

Data on Tuesday (Sept 8th) showed that the 19-nation eurozone grew by 0.4 per cent in Q2, revising upward a first estimate that sparked worries about the health of the European economy. The more upbeat data comes as concerns are growing about the global economy, hit by a slowdown in powerhouse China that has spooked financial markets. The revised figures still demonstrate that the eurozone economy suffered a slowdown in the first half of 2015, despite a massive stimulus programme from ECB to boost the fragile recovery.

"From a broader perspective, we should take into account that a further slowdown in China will likely have a much more significant impact on the Asian region. This will obviously have further knock-on effects on global growth and, hence, also on the eurozone, via exports and the world trade channel", says Rabobank in a research note.

The 'China factor' hasn't made life for the ECB any easier. The Governing Council has to weigh the negative knock-on effects on eurozone growth against potential terms of trade benefits. The ECB has already shown concern over the potential impact in its recent minutes noting: "In particular, financial developments in China could have a larger than expected adverse impact, given this country's prominent role in global trade."

For now, it is too early to expect the ECB to make any major changes to its monetary policy. The central bank may first want to have a stronger grip on how all these factors play out. However, verbal intervention comes cheap and is likely to be a good starting point for President Draghi.

Euro weakened on Wednesday as a recent unwinding of risky euro-funded carry trades took a breather. EUR/USD was trading at 1.1156 and EUR/GBP was trading at 0.7264 at 1120 GMT.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary