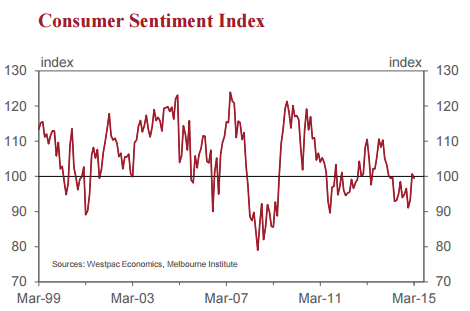

The Westpac-Melbourne Institute Index of Consumer Sentiment declined by 1.2% in March from 100.7 in February to 99.5 in March.

Some softening in sentiment was always likely in March given the big lift last month following the RBA's surprise 25bp rate cut. Interest rate moves often generate a big initial reaction that dissipates over time.

That pattern may have been dampened this time by the Reserve Bank's move to an overt easing bias at its March meeting although many, including ourselves, had been expecting the Bank to make a further 25bp cut in rates.

Other factors likely contributed to the softening in sentiment this month is petrol prices which rose sharply, pump prices up 14c a litre, reversing most of the 22c decline over the previous two months.

The December quarter national accounts also presented another weak read on the economy with growth of just 0.5%qtr and 2.5%yr.

Westpac notes in a report on Wednesday:

- The Reserve Bank Board next meets on April 7. We continue to see a clear case for lower rates. Although there were some encouraging details in the December quarter national accounts, growth momentum remains well below the Reserve Bank's assessed 'trend' pace of 3.25%.

- With concerns that sub-trend growth may persist for longer than had been assumed through most of last year, that points to continued downside risks to the outlook.

- In effect, neither the national accounts nor sentiment have delivered enough 'good news' to tilt the balance of risks back to even. As such, we continue to expect another rate cut of 0.25% in the April/May 'window'

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed