Industrial production in Taiwan rose during the month of September, slightly beating what markets had initially anticipated, boding well for the upcoming third quarter gross domestic product (GDP).

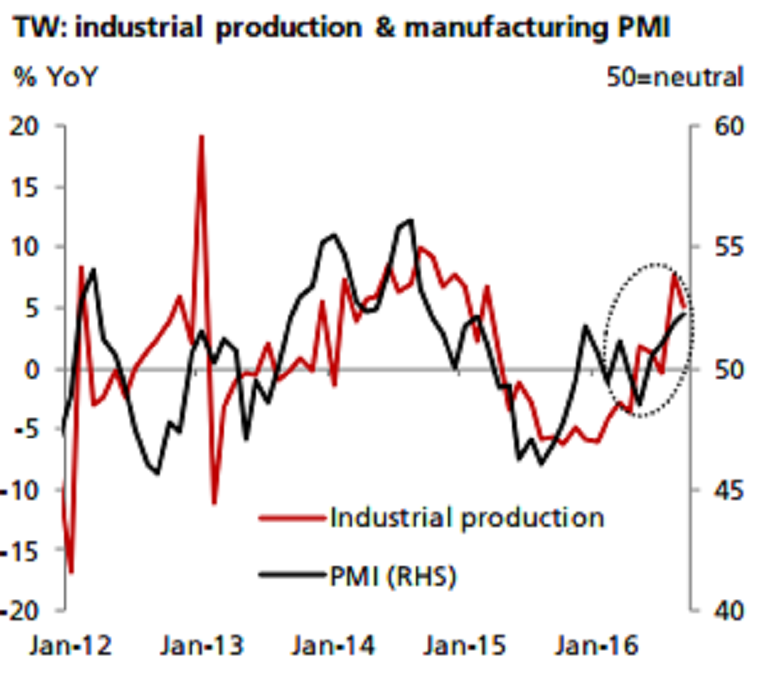

Taiwan’s September industrial production rose slightly more than expected by 5.0 percent y/y. This brought the average production growth to 4.1 percent in Q3, a notable rebound compared to -0.2 percent in the second quarter.

In sequential terms, industrial production slipped -0.7 percent m/m on a seasonally adjusted basis in September, a technical payback from the 1.8 percent rise in August. In the whole quarter, production growth remained strong at 9.0 percent q/q, on a seasonally adjusted annual rate (saar).

The rise in the industrial production set the stage for the country’s upcoming gross domestic product (GDP) for the third quarter, scheduled to be released on October 31, Monday. A year-on-year growth of 2 percent appears pretty much achievable. This will be the second straight quarter of positive growth, and a significant rise compared to 0.7 percent in 2Q, DBS reported.

However, growth is expected to remain sidelined as the country’s manufacturing sector seems to recover on a dull path, coupled with weakness in the domestic services sector. Meanwhile, domestic consumption demand is still on the soft patch currently, in face of sluggish consumer confidence, a weak labor market and the lack of powerful policy stimulus.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals