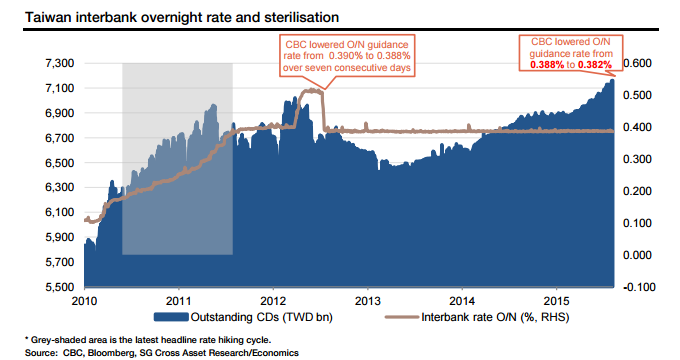

Taiwan's central bank reportedly lowered the overnight (O/N) guidance rate for a third consecutive day by another 0.2bp to 0.382% for a total of 0.6bp. This is after a long period of stability dating back to August 2012. The 14-day certificate of deposit (CD) rate issued by the central bank will also be lowered to 0.47% from 0.50%.

These measures are de facto monetary easing. The central bank has effectively brought market rates down using these supplementary tools and it is very likely to lower the O/N guidance rate and CD rates further. However, the chance of headline easing, i.e. discount rate cuts, has diminished.

In July 2012, the CBC lowered the O/N guidance rate from 0.506% to 0.388% over seven consecutive working days - a cut of nearly 2bp each day. But they did not follow up with headline rate cuts, not even in 2013 when growth remained soft and inflation weakened.

This time round, the pace of cutting the O/N guidance rate is much slower at 0.2bp per day. Meanwhile, the pace of sterilisation of excessive liquidity has slowed only fractionally in the first two days and even increased in the third day, suggesting that there is still ample onshore liquidity. These moves indicate that the CBC is very cautious about further easing and is only willing to take minimal action for now, although there are certainly increasing concerns about the growth outlook.

Taiwan: A headline rate cut could do more harm than good

Thursday, August 13, 2015 11:17 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX