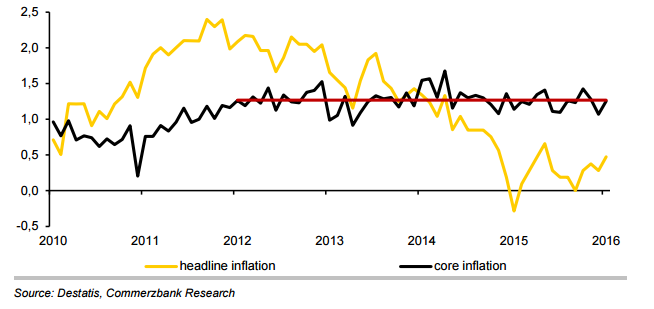

Preliminary state data released on Thursday indicated that German inflation inched up in January, but overall price pressure remained weak, which may embolden proponents of further central bank stimulus. The German inflation rate rose to 0.5% in January, as expected. However, while the headline inflation is doing flips and twists due to the volatile energy prices, the core inflation rate (without food and energy) has remained at around 1.3% since 2012. The reading was the strongest since May 2015 but still far from the ECB's target.

Volatility in energy prices is causing a rather erratic movement in the headline inflation, but core inflation rate is looking as solid as a rock, hovering around 1.3% since 2012. Nothing has been able to really push the core rate higher, figures highlight the European Central Bank's struggle in hitting its inflation target of just under 2 per cent. The ECB ultra-loose monetary policy has largely fallen flat without having much effect on the real economy.

German consumer prices account for almost 30% of the euro zone index. With the continued slump in energy prices, further second-round effects on other goods and only little pricing power from retailers and producers, a strong acceleration of German inflation any time soon is far from real. From the ECB's perspective, the steadfast anchor of the German core inflation rate constitutes a bar that is preventing the euro zone inflation rate from rising towards the 2% target.

"We do not believe that the euro zone inflation rate will move very quickly towards the ECB inflation target. Besides still not anchored inflation expectations, the slack economy and barely rising credit demand, this should lure the central bankers into further loosening monetary policy possibly in March, possibly by lowering the deposit rate by a further 10 basis points", says Commerzbank in a research report.

Fundamental deflationary pressures persisting elsewhere in the euro zone and worryingly low inflation expectations give the ECB every reason to provide more policy support. ECB President Mario Draghi has said the bank still has plenty of options left, suggesting it could act as early as March. A majority of economists in a Reuters poll said the ECB is likely to cut its deposit rate again in March.

"For the ECB ... the challenge has not become any easier. In fact, German inflation data are welcome arguments for the opponents of additional ECB action," ING Bank analyst Carsten Brzeski said.

Eurostat's flash estimate released today showed Eurozone headline inflation recovered to 0.4% y/y in January, up from 0.2% in December. The more important core inflation increased to 1.0% y/y from 0.9% previously. The ECB will have February monetary developments and inflation data to assess whether low oil prices are making their way into core inflation. For now we feel the ECB is likely to cut its deposit rate again in March. EUR/USD was little changed after Eurozone CPI data, trading at 1.0915 as of 1030 GMT.

Subdued German core inflation to push ECB into further loosening monetary policy, possibly in March

Friday, January 29, 2016 12:08 PM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?