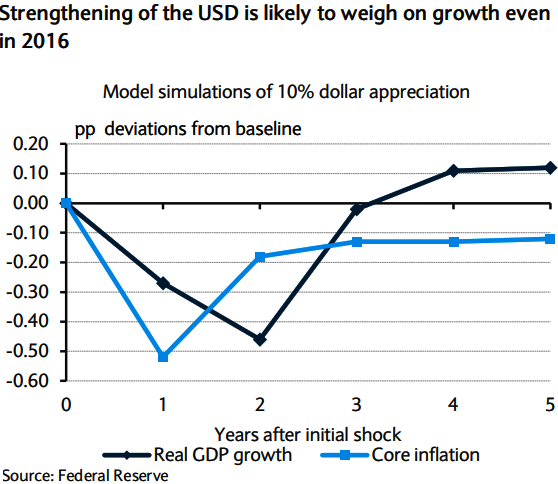

We reckon the strengthening of the USD is likely to weigh on the Fed's forecasts the most. While the fall in energy prices may be expected to provide a boost, the sell-off in the equity markets should offset that. Vice Chair Fischer squabbled that a 10% appreciation would put forth a 0.3% drag in the first year but almost 0.5% in the second year as shown in the diagram.

This suggests that the drag from the trade channel can persist through 2016 and that there is room for those growth forecasts to fall. Similarly, on the inflation front, YoY core PCE has drifted further away from the target, the USD has strengthened and energy prices have fallen since the June meeting. At the June meeting, the Fed forecast real GDP growth of 1.9% in 2015, rising to 2.55% in 2016 and YoY core PCE inflation to rise significantly to 1.75% by YE-16 from 1.35% at YE-15. With growth in the first half now looking better (at 2.15%), the Fed is likely to increase its 2015 forecast. However, at the same time, the tightening in financial conditions since the June meeting should weigh on 2016 forecasts.

What if Fed raises rate and what would be the impact:

Raising rates at the next meeting, even as it is just 25 bps would signal a hawkish shift in the reaction function. The Fed would be conveying that despite the tightening in financial conditions and the decline in realized core inflation, it has now become reasonably confident that inflation will move back to its 2% objective over the medium term. This would imply that policy is being driven primarily by the unemployment rate, a notion the Fed has tried to dismiss in the past.

We believe that financial conditions would tighten further in that scenario and it would be difficult to justify making policy less accommodative on the basis what the Fed has conveyed so far, even if marginally.

Strengthening dollar to prop up growth forecasts

Friday, September 11, 2015 11:21 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings