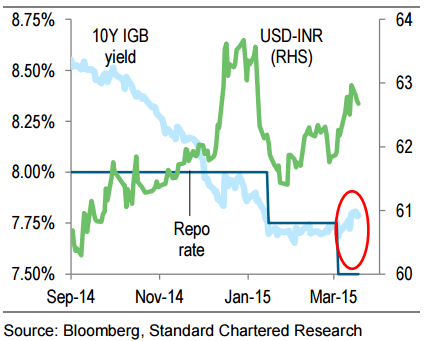

Recent price action in Indian government bonds (IGBs) is perplexing. The benchmark 10Y IGB yield has risen c.13bps and the 5Y OIS c.17bps, and the OIS curve has bear steepened c.7bps since the Reserve Bank of India (RBI) surprised the market with a 25bps inter-meeting policy rate cut on 4 March.

Large local investors (publicsector banks, private-sector banks and mutual funds) have, in aggregate, net soldc.INR 26bn worth of IGBs since then, whereas they net bought INR 159bn worth in February.

Standard Chartered notes its views as follows....

- First, we believe local banks are booking profits on their long IGB positions ahead of the financial year-end on30 March. Second, market expectations of a policy rate cut at the 7 April Monetary Policy Committee meeting appear to be gradually unwinding. Notwithstanding near-term IGB weakness, we have a Positive outlook on IGBs.

- We think domestic inflation dynamics are favourable and that the RBI has room to lower policy rates further. We expect the central bank to lower the repo rate 50bps (to 7.00%) during the remainder of 2015. Monetary-easing expectations should prompt local investors to build long IGB positions once the new financial year begins on 1 April.

- Foreign investors are positive about the Indian local-currency debt market; they are increasingly using up their corporate bond quota, with utilisation currently at an all-time-high of 74% (versus 59% on 1 January). The 16 March IGB quota auction saw strong bidding interest, with a bid-to-cover ratio of 2.63 and a feecut-off of 100bps.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX