Japan Investment Corp., a government-backed fund, plans a bold $7 billion acquisition of global photoresists leader, JSR Corp., to amplify Japan's semiconductor self-sufficiency. This strategic move highlights the nation's increased focus on economic security and industrial competitiveness.

JSR, which holds a 30% share of the global market of photoresists, a critical chemical agent for manufacturing semiconductors, is expected to be delisted from the Tokyo Stock Exchange as early as fiscal 2024 if everything goes as planned. This will enable JSR to make management decisions on critical issues such as restructuring businesses and investments in growth sectors. The fund plans to invest ¥500 billion, with Mizuho Bank expected to lend about ¥400 billion.

The Japanese government is moving aggressively to beef up the domestic supply chain for semiconductors, which it considers a strategic commodity for economic security and national interest. According to Prime Minister Fumio Kishida, it is vital to secure an industrial base of semiconductor technology in Japan, not only to strengthen industrial competitiveness but also from the standpoints of decarbonization and economic security.

The Ministry of Industry revised its semiconductor and electronics industry strategy, aiming to increase annual domestic sales of semiconductor products threefold to more than ¥15 trillion. The ministry has also authorized a ¥330 billion subsidy to a new Hokkaido factory planned by Rapidus Corp., a semiconductor joint venture co-created by leading Japanese companies, including Toyota Motor Corp. and NTT Corp.

JSR said nothing was decided yet, but its board would discuss the matter on Monday after the Nikkei business daily reported that JIC was in talks to purchase the company via a tender offer as early as this year.

JSR, a company specializing in semiconductor materials and medical business, has reported a net profit of ¥15.7 billion on sales of ¥409 billion for the business year ending in March. The company, originally established as Japan Synthetic Rubber Co. in 1957 to produce synthetic rubber in Japan under a national policy, has since become a purely private-sector enterprise and has diversified into several business areas.

JSR is expecting a net profit of ¥25 billion on sales of ¥442 billion for the current business year. It strives for excellence in its field, and with its track record of success, JSR is poised for continued growth and innovation.

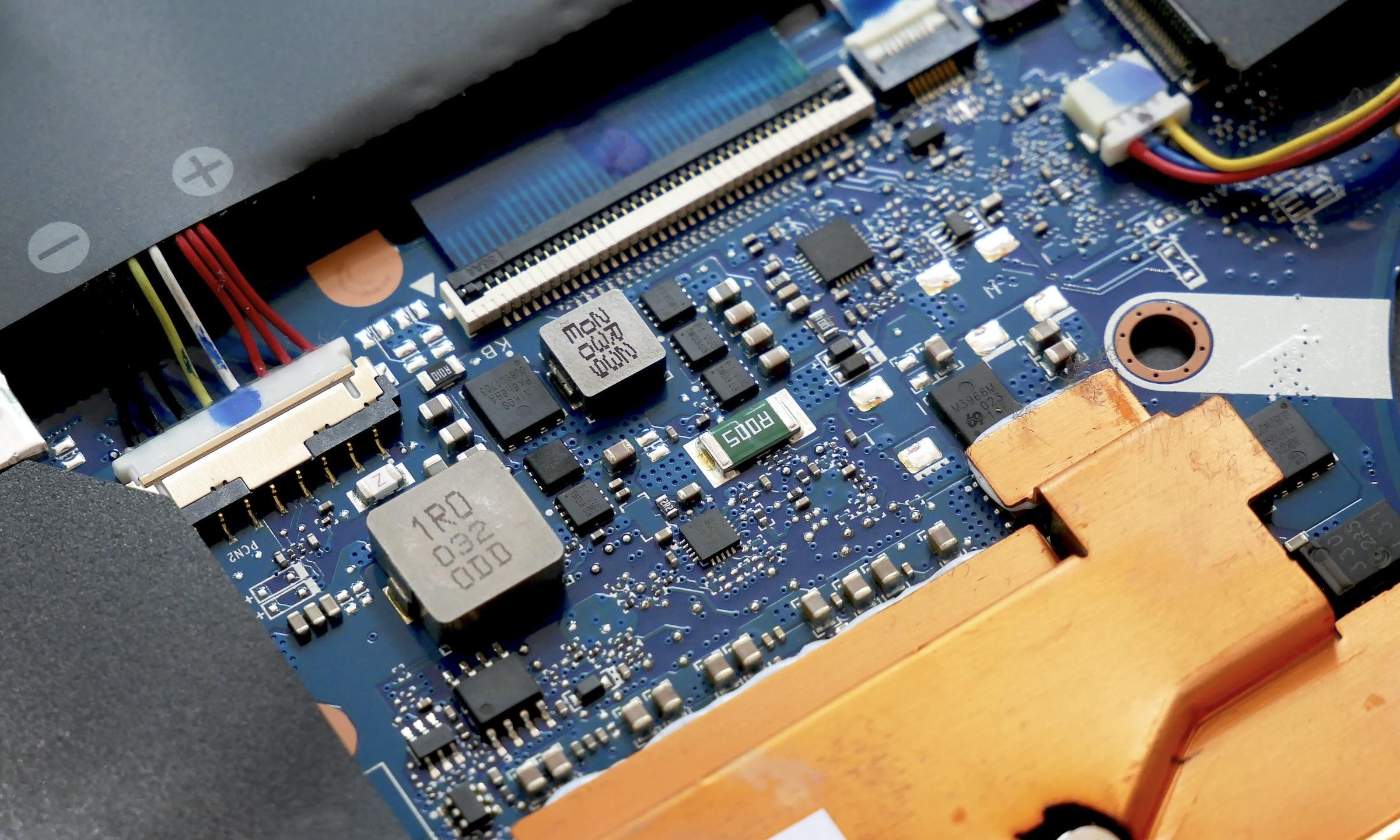

Photo: Vishnu Mohanan/Unsplash

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering