Fitch cut its sovereign rating by one notch to BBB-, (from BBB), with a stable outlook late on Friday. The move followed Standard & Poors change of outlook for the sovereign from stable to negative, earlier during the day. Both rating agencies are now rating the sovereign just one notch above "junk"-status. Moody's is alone to rate the sovereign two notches above "junk" at Baa2 on its rating-scale.

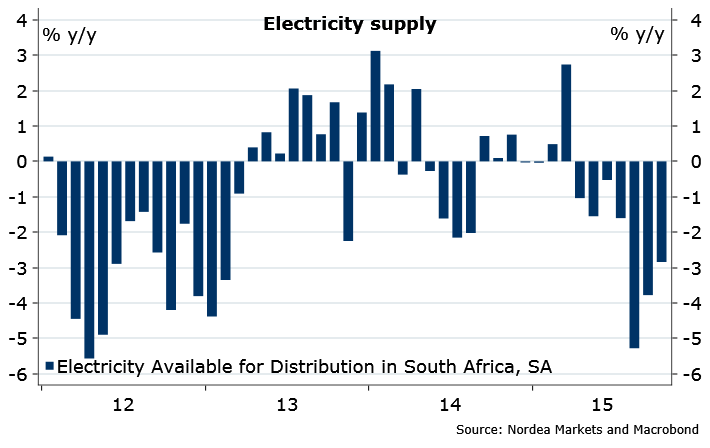

The decision to cut the rating was a result of the weakening of GDP growth and growth potential. Lower commodity prices and a persistent electricity shortage have weighed on growth. The economy registered a contraction of economic activity in Q2, and managed to just briefly escape a recession in the third quarter as growth picked up to an annualised rate of 0.7% q/q. However, this rate was lower than the consensus expectations of an increase of 1.1% q/q, showing headwinds to economic activity remain large.

"We expect growth of around 1.0% for 2015, and to remain weak in 2016. New power capacity through additional units at the power stations at Medupi and Kusile is not expected to be completed until 2018, which will constrain growth from picking up to higher levels", says Nordea Bank.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022