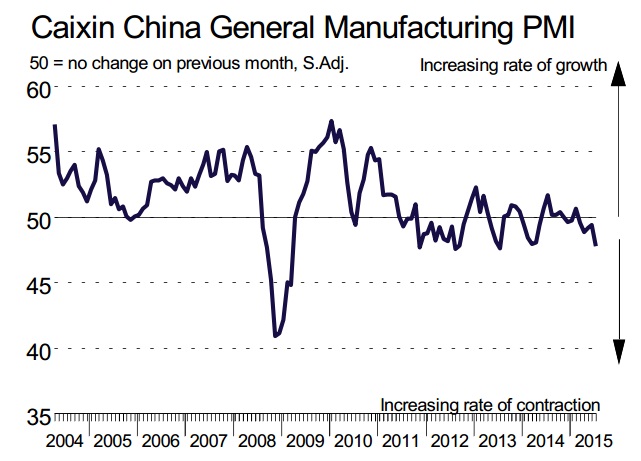

Latest PMI report points at continued slowdown of China's robust manufacturing sector.

- Over the weekend, release of China's official PMI pointed at stalled growth for July with a reading of 50.

- Today, Caixin official PMI pointed to further slowdown in growth which inevitably pointing to a crisis. The reading came at 47.8 in July, much lower than 49 in June and lowest in 24 months.

Key highlights from Caixin manufacturing PMI -

- Weaker demand contributed to reduction in output at sharpest pace in 44 months. The rate of reduction in new orders were sharpest since 2012.

- Rate of jobs shedding has eased somewhat, nevertheless employment has continued to decline for 21 consecutive months.

- Both input and output prices have declined again and at sharpest pace since April and January.

Continued slowdown in economic activities, demand urgent attention from Authorities and prompt action.

Chinese authorities are focused into country's stock market, which they are struggling to save from Crash.

Chinese benchmark stock index, Shanghai composite slumped -1.1% and closed at 3623.

With economic slump and battered stock market, case for further easing from Peoples bank of China growing stronger.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?